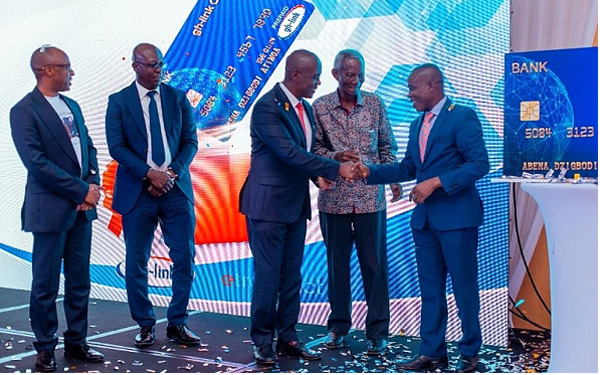

Dr Settor Amediku (right) is congratulated by Kwame Pianim and an official of eTranzact after launching the card as Archie Hesse and George Babafemi look on

ELECTRONIC PAYMENTS and aggregation solutions firm, eTranzact, in partnership with the Ghana Interbank Payment and Settlement Systems (GhIPSS) on Monday, launched the Gh-link EMV debit and credit cards.

An improvement over the Ghlink Card, CEO of GhIPSS, Archie Hesse, said the new cards would complement the government’s digitization and financial inclusion efforts.

Mr Hesse said, “By December 31,this year, all banks must issue this card to every bank account holder. The need for Ghana to embark on this journey is very clear. In the past, Ghana had only an international scheme card.”

Explaining the benefits of the cards, he said the prices of the cards were determined locally and not by international scheme owners as was the case previously.

The CEO of GhIPSS continued that to allow for quick deployment of the cards, his outfit had partnered GOIL to offer the cards to all motorists.

Christened Gh Dual card, the new product inculcates the e-Zwich and gh-link applications, and could be used either as e-Zwich, gh-link or both as desired on payment platforms.

According to officials of GhIPPS, the card has been designed to give cardholders access to both funds on their e-Zwich cards and in their bank accounts at the same time.

Director of the Payment Systems Department at the Bank of Ghana (BoG), Dr Settor Amediku, who launched the cards on behalf of the Governor of the BoG indicated that banks that failed to do as expected would be penalized.

According to George Babafemi, Executive Director for eTranzact Ghana, said GhIPPS migrated its gh-link platform to Europay, Master Card and Visa (EMV) to conform to global payment card standards adding that resourcing the improved gh-link prepaid card was easy, since it connects with any mobile wallet, bank account, or another cardholder.