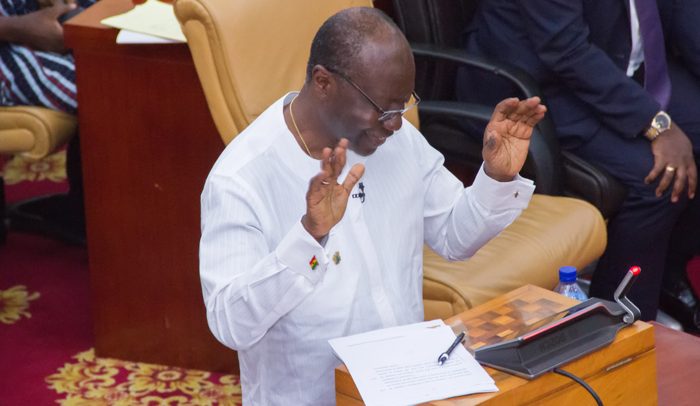

Ken Ofori-Atta

Finance Minister, Ken Ofori-Atta has indicated that less than 10 per cent of Ghanaians pay direct taxes.

The Minister said the figure which was informed by the 2021 Population and Housing Census is a poor reflection of the country as compared to other middle income countries.

“Only 2,364,348 are bearing the burden of the entire population as taxpayers as of August 2021,” he outlined in his budget presentation in Parliament on Wednesday.

He said the trend needs to be addressed “to build a more equitable society.”

He noted that only 45,109 entities in the country are registered as corporate taxpayers with only 54,364 persons registered as self-employed taxpayers at the Ghana Revenue Authority.

“Only 136,198 entities are registered businesses at the Registrar-General’s Department as at August 2021, of which 80 percent are self-employed,” the Minister added.

According to the figures the Finance Minister presented, the Greater Accra Region contributes almost 90 percent of Ghana’s domestic tax as of June 2021.

“The Ashanti, Western and Eastern regions together contribute barely to 3 percent of domestic taxes,” he added.

Mr. Ofori-Atta urged the country to resolve that “by the next census, we should have changed these statistics to become an Upper Middle-Income Country in line with our Ghana Beyond Aid agenda.”

“We must eclipse a 20% threshold of revenue to GDP ratio by 2024,” he noted as a target.

By Jamila Akweley Okertchiri