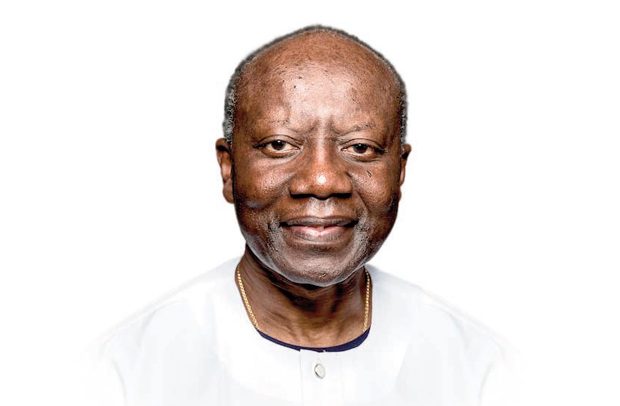

Ken Ofori-Atta

The government has been under intense pressure to rethink its Debt Exchange Programme (DEP) to reassure financial markets and stabilise the economy, with warnings coming from several quarters to put the programme on hold.

It appears this time, both the Majority Caucus and the Minority Caucus in Parliament are singing from the same page, demanding that the government do further consultations on the planned debt exchange announced last year.

On December 5, 2022, the government launched Ghana’s Domestic Debt Exchange (DDE) programme, an invitation for the voluntary exchange of approximately GH¢137 billion of the domestic notes and bonds of the Republic, including E.S.L.A. and Daakye bonds, for a package of new bonds to be issued by the Republic.

The government is now contemplating of adding to the exchange bonds held by individuals (natural persons), which was previously excluded, alongside Treasury Bills in totality, and notes, sparking off agitations.

Deadline Extension

Already, agitations from some bondholders, who planned to protest against the inclusion of individual bonds in the debt programme, has already forced the government to extend the deadline for the programme to Tuesday, January 31, 2023.

The Finance Ministry said the extension was meant to enable it to build consensus among bondholders for the programme. This is the third time the government has extended the deadline for the bondholders to voluntarily exchange their bonds for new ones.

Initially, the government decided to extend the expiration date of the voluntary offer to Friday, December 30, 2022, with a contemplated settlement date on Friday, January 6, 2023.

Majority

Majority Leader, Osei Kyei-Mensah-Bonsu has already warned against the inclusion of bonds held by individuals without extensive engagement with them, noting that this could wipe away the middle class of the country.

“What we are talking about is that many of these bondholders also belong to the middle class and that’s where the major worry is,” he stated and added that such a thing could be dangerous.

“I’m not sure the government takes interest and joy in suppressing anyone, no government will have any joy in doing that. So, the government thinks that this is the best way forward.

“However, even if it is, we need to engage, reflect and then move on and that will encourage some people who have some doubt to better appreciate where we are,” he said, while receiving a petition from some bondholders in Parliament.

The Majority Chief Whip, Frank Annoh-Dompreh also tweeted, “The Finance Ministry (Minister) must, as a matter of urgency, review ASAP its decision and resolution on individual bondholders.”

“I don’t agree with them and I think it’s unfair and untenable,” the NPP MP for Nsawam-Adoagyiri added.

Minority

The NDC Minority group in Parliament has also waded into the issue of the Debt Exchange Programme, calling on the government to immediately suspend it.

According to them, the DEP was a risk to financial institutions and insurance companies in the country, noting, “Our banks and other financial institutions are still reeling after the infamous financial sector bailout.”

Speaking at a press briefing in Parliament yesterday, Minority Leader, Haruna Iddrisu said the DEP would further exacerbate the “already perilous financial sector.”

He added, “The last thing Ghanaians would want is a total collapse of the financial sector by a government which went haywire on a borrowing spree. The future sustainability of our insurance companies cannot be guaranteed under this poorly crafted Debt Exchange Programme.”

The Minority Leader said the DEP was certainly not in the best interest of Ghanaians, asserting that there should be “deeper consultation and greater transparency about Ghana’s total debt and its management.”

He stated that the government could not continue to manage Ghana’s economy like a private entity, and continued that Ghanaians deserved to know how much was involved and how long the debt exchange would take.

“It is not just about people’s investment, but it is much more about people’s lives and livelihood,” the NDC MP for Tamale South intimated.

For him, it is trite knowledge that a substantial number of monies in financial institutions come from private individuals.

“It is, therefore, highly reprehensible for the Finance Minister to say that financial institutions will be affected by the Debt Exchange Programme but individual bondholders will not be affected.

“What kind of warped logic is this?” he quizzed, and added that the current challenges had come about because the government failed to fully engage the relevant stakeholders in the DEP.

Economy

Mr. Iddrisu alleged the government had collapsed the economy and that the unsustainable public debt, depreciation of the currency, hyperinflation and rising interest rates were a few of the symptoms.

According to him, by June 2022, Ghana’s Total Public Debt had ballooned from GH¢120.4 billion in 2016 (55.9% of GDP) to GH¢467.4 billion (78.3% of GDP) and this is projected to rise to 104% of GDP at end-2022 when contingent liabilities of State-Owned Enterprises are included.

“The international capital market, which had been available to the Ghana Government to sell Eurobonds, lost faith in our ability to service loans and shut us out,” Haruna posited.

He pointed out that there was sufficient time and opportunity to avert economic collapse in 2021 by taking advantage of some debt relief initiatives tabled by some multilateral and bilateral partners to reduce our debt.

Among these was the Debt Service Suspension Initiative (DSSI) which would have resulted in the lowering of the amount of revenue we pumped into debt service, he noted.

GFSF

So far, Ghana Financial Stability Fund (GFSF) has been established with a target size of GH¢15 billion to be provided by the government and the country’s development partners.

The Fund will provide liquidity to financial institutions that participate fully in the debt exchange. All financial institutions (banks, SDIs, pension schemes, collective investment schemes, fund managers, broker/dealers, insurance firms) that fully participate in the debt exchange can access the GFSF for augmented liquidity support, with effect from the date of completion of the debt exchange.

The Fund will be managed by the Bank of Ghana under unique operational guidelines being developed by the Financial Stability Council.

By Ernest Kofi Adu