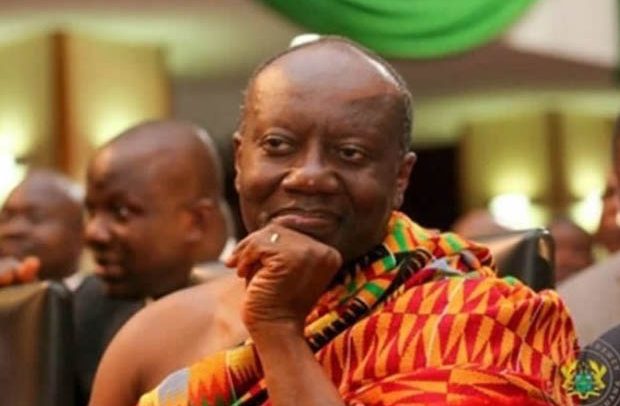

Ken Ofori Atta

The need to finance critical infrastructure projects and manage liability has pushed government to consider issuing sovereign bonds of up to US$3 billion at “least cost” and minimum prudent level of risk.

According to Ken Ofori-Atta, Finance Minister, government would explore the possibility of issuing one or a combination of bonds based on market conditions whether Eurobond or Green bond.

“We inherited over GH¢120 billion of debt at very high interest rates. Even though we have brought down interest rates considerably, we are still saddled with a sizeable amount of expensive debt. As such, in 2019, we will spend over GH¢16 billion of our revenue (over 26.6%) on interest payments. This amount can be considerably reduced if we refinance our debt at much lower interest rates.

“A 10 percent reduction in the interest rates translates into over GH¢1.6 billion in savings; almost enough to pay for Free SHS in 2019.”

Explaining further, Mr. Ofori-Atta said the move would help provide government with the wherewithal to refinance expensive liabilities.

“It’s an important bulwark for Ghana’s post IMF status, it indicates a country with a long-term plan, a country that can programme its infrastructure needs, a country that can provide adequate foreign exchange reserves.”

Government announced its intention to issue longer dated sovereign bonds this year as part of its bilateral engagement with other countries.

He said the phase of massive economic transformation required a more ambitious financing arrangement and the capacity to retire about half of the country’s existing debt, which was issued during a high interest rate environment during the previous administration.

“The decision to raise these ultra-long-term bonds is not intended to derail our debts sustainability path, but rather to enhance it.

“If we really want to uplift ourselves out of this hand-to-mouth existence and put our country Ghana on a firm trajectory of growth and prosperity, we will need to source long-term affordable financing to invest in strategic infrastructure over the medium to long-term.”

He also emphasised that “we shall issue sovereign bonds of longer tenor either as green bonds or Eurobonds on the international capital markets and also structure a Sovereign Century Fund for our bilateral investor partners. The Sovereign Century Fund shall engage on a bilateral basis to raise long-term concessional financing to underwrite our other commercial infrastructure needs through GIIF, GIADEC, PPP projects and other entities, as well as liability management.”

By Samuel Boadi