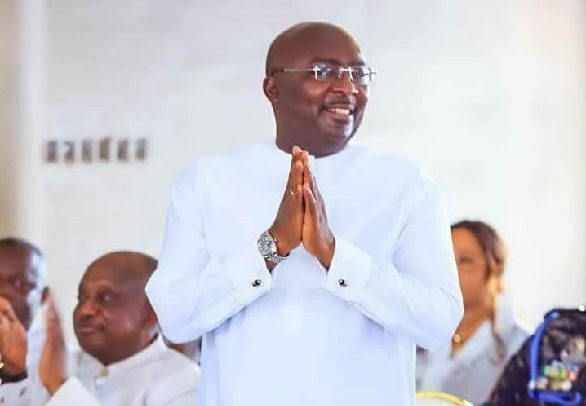

Dr. Mahamudu Bawumia, the New Patriotic Party’s (NPP) flagbearer, has reaffirmed his commitment to revolutionizing Ghana’s tax system with a flat-rate tax model, drawing inspiration from Estonia’s success story.

This bold move aims to simplify tax administration, stimulate business growth, and reduce government spen ding by 3% of GDP, equivalent to approximately GH₵30 billion.

Speaking at the NPP’s manifesto launch in Takoradi, Dr Bawumia emphasized the need for a streamlined tax system, stating, “Our current tax system is complex and opaque, making it difficult for businesses to navigate. By introducing a flat rate tax system, we will provide taxpayers with clear visibility into their obligations, making it easier to file and pay their taxes.”

Ghana’s tax landscape has been marred by complexity, with multiple tax rates and exemptions, leading to confusion and inefficiencies.

The proposed flat-rate tax system aims to address these challenges, promoting transparency and ease of compliance.

Dr Bawumia’s tax reform plan is complemented by a pledge to reduce government spending by 3% of GDP, redirecting resources towards private sector involvement in public infrastructure and services.

This move is expected to support job creation and economic development, as Dr. Bawumia explained, “Our plan is to cut 3% of GDP from government expenditure and direct these resources towards private sector provision of public infrastructure and services.”

The NPP flagbearer also highlighted the importance of currency stability, citing the party’s proven gold purchase program as a key tool to achieve this goal.

“We will use our proven gold purchase program to stabilize the currency, provide businesses with planning predictability, and ensure stability in input prices,” he assured.

In addition to the flat-rate tax system, Dr. Bawumia proposed a Tax Amnesty Program to support industry expansion, increase hiring, and stimulate economic activity.

This program aims to provide relief to businesses and individuals with outstanding tax liabilities, encouraging them to comply with the new tax regime.

With these comprehensive tax reforms, the NPP aims to create a business-friendly environment, driving economic growth and development in Ghana.

-BY Daniel Bampoe