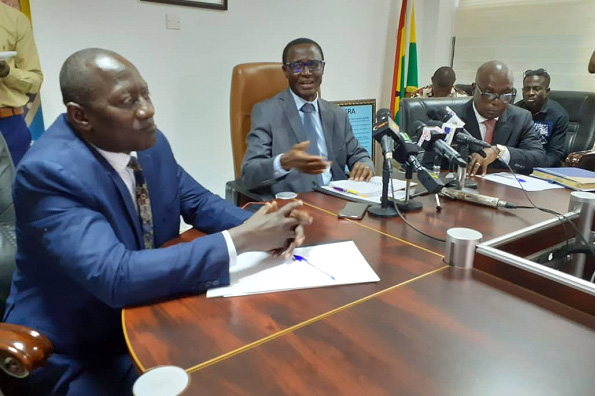

Ammishaddai Owusu-Amoah (middle) addressing journalists

The Ghana Revenue Authority (GRA) has warned taxpayers nationwide not to think that the recent fire incident at its Kwame Nkrumah Circle Office in Accra, has shifted its focus from collecting taxes.

COMMISSIONER GENERAL of the Ghana Revenue Authority (GRA), Ammishaddai Owusu-Amoah, says his outfit is lacing its boots to intensify the prosecution of defaulting taxpayers and also have their names published in the national dailies.

“We are calling on the affected taxpayers to come forward to settle their tax debts and failure to do that will lead to prosecution actions being initiated against them,” he said.

The Commissioner General, who was speaking at a press conference yesterday, on the fire outbreak at its Kwame Nkrumah Circle office in Accra, warned taxpayers nationwide not to think that the fire incident would affect GRA’s tax collection.

“We are therefore cautioning taxpayers that the fire outbreak has not shifted our focus from our goal of maximizing revenue at this crucial time,” he noted.

The fire outbreak occurred on Sunday morning, December 1.

According to him, the second floor of the GRA office at Kwame Nkrumah Circle was completely ravaged by the fire which has led to some losses.

He said GRA was still awaiting the report from the Ghana National Fire Service to determine the next line of action with regard to that building.

“I will however reiterate that the GRA has a backup system, so there will not be any loss of data or loss of money,” he said.

He however bemoaned that “it is unfortunate that the authority has suffered this setback at a time when we are at a critical period in our revenue mobilization drive.”

He noted that “the authority is however still focused and is still poised to working hard to attain the needed revenue for national development.”

Stop gap arrangements

He stated that some arrangements have been made since the incidence.

According to him, large taxpayers who interact business at the Large Tax Office (LTO) can transact business at Kinbu Sub LTO, at the Head Office, Ministries; Kaneshie MTO, Dadeben Road, Katenit, Building Kaneshie Industrial area; Osu MTO, Mission Street, Papaye Down, Legon MTO, Tema MTO.

He noted that the authority had also put in place measures to help the affected staff in dealing with the loss suffered by offering them counseling and psychological support.

Redeployment

He revealed that “to ensure the smooth running of our operations, staff from the affected offices have been redeployed to other GRA offices to enable them work effectively and also make it convenient for our taxpayers of the LTO.”

Improvement In Tax Revenue

“The authority has in the past couple of years fallen short of its revenue target,” he recounted.

However, he said, tax revenue in 2019 has grown by 12.8? over 2018 collection.

BY Melvin Tarlue