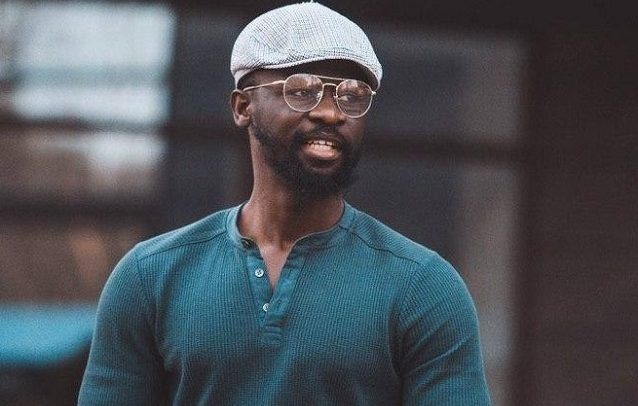

Clifford Cheqona

Trader’s psychologist, Clifford Cheqona, has called on financial institutions to intensify financial literacy advocacy programmes to reduce the rate at which traders in the country fall victim to scams involving unauthorised investment firms.

Speaking on Guide Radio’s Up and Running Morning Show, regarding the recent closure of Dek-Nock Investment Firm by the Bank of Ghana (BoG) for engaging in unauthorized deposit-taking, Mr. Cheqona emphasised that the situation could have been avoided if financial literacy had been prioritised.

He explained that financial literacy can significantly reduce the likelihood of traders being scammed by unauthorised investment companies.

“With a solid understanding of the investment sector, traders can recognise legitimate investment products, avoid suspicious ones, and check for regulatory warnings before making investments,” he said.

Mr. Cheqona added that financially literate traders are better equipped to identify warning signs of scams, such as unrealistic returns, unregistered investments, or pressure to invest quickly.

He also noted that they are able to verify the credentials of investment professionals and companies before entrusting them with their moneies.

“The government’s decision to shut down this firm is a positive step towards protecting investors. However, the critical question that remains is what measures are being implemented to help people access this vital information before they become victims? The priority for the government in safeguarding traders should be education—specifically, educating them on how to identify fraudulent investment activities,” he stated.

It is worth noting that the BoG, in collaboration with the Ghana Police Service, has closed down Dek-Nock Investments, located at Nungua and Ashaiman in the Greater Accra Region.

This action was taken under Section 20(2)(g) of the Banks and Specialized Deposit-Taking Institutions Act, 2016 (Act 930).

A statement signed by Central Bank Secretary, Sandra Thompson, indicated that Dek-Nock Investments was engaged in unauthorised deposit-taking, violating Section 6(1) of Act 930.

The statement further noted that the Ghana Police Service is conducting ongoing investigations into the operations of Dek-Nock Investments and urged all customers to remain calm during the process. The Bank assured the public of its commitment to promoting the integrity and stability of the country’s financial system.

By Prince Fiifi Yorke