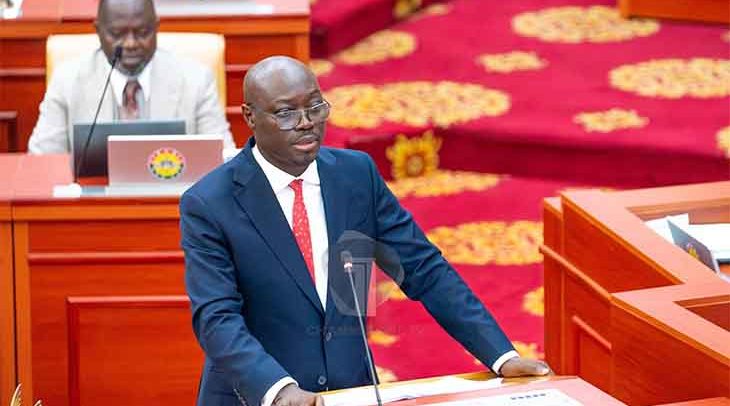

Dr. Cassiel Ato Forson

The Government has introduced a new petroleum levy aimed at resolving the country’s mounting energy sector debts and avoiding what Finance Minister Dr. Cassiel Ato Forson describes as “an imminent collapse” of the power sector.

Presenting the Energy Sector Levy (Amendment) Bill in Parliament yesterday, Dr. Forson said the new measure would raise additional revenue to pay off legacy energy sector debts and fund critical fuel procurement for thermal power generation.

“The object of this bill is to raise additional revenue to support the payment of energy sector shortfalls, reduce legacy debt and stabilise power supply,” the minister told the House and added, “The power sector is the biggest economic and fiscal risk we face presently. It could lead to a major crisis if we fail to confront it head-on.”

The Finance Minister revealed that the country’s energy sector debt stood at US$3.1 billion as of March 2025. This figure includes amounts owed to independent power producers, fuel suppliers, and state-owned enterprises. Due to non-payment of bills, key financial guarantees, including a US$512 million World Bank IDA guarantee and a US$120 million GMPC guarantee, were fully drawn down in 2024.

“To restore these guarantees alone, the government requires an additional US$632 million,” he said, noting that at least US$3.7 billion will be needed to clean up the sector’s overall debt.

Ghana’s growing reliance on thermal power has led to increasing fuel costs not covered under current electricity tariffs. Including liquid fuel costs in the tariff structure would lead to a 50% rise in electricity prices, according to the Public Utilities Regulatory Commission (PURC)—a move the minister said would harm households and businesses.

“In 2025, we will need US$1.2 billion to procure fuels for thermal power alone,” Dr. Forson stated. “The fiscal space cannot absorb this.”

To address the funding gap, the bill proposes a GH¢1 levy on every litre of petrol, diesel, and related products. The minister assured the House that this would not result in an increase in fuel prices, due to the strong performance of the Ghana cedi.

“Simulations show there will be no increase in the ex-pump price of petrol and diesel in the current pricing window if this levy is imposed,” he said, noting, “The impact will be absorbed by currency gains.”

Minority Pushes Back

The introduction of the levy, however, drew sharp criticism from the Minority, led by Alexander Afenyo-Markin, who accused the government of reintroducing a version of the repealed Electronic Transactions Levy (E-Levy) under a different name.

“You said in your budget that you won’t introduce new taxes. You repealed the E-Levy, and now you reintroduce it under the guise of an Energy Sector Levy and want to rush it through under a certificate of urgency,” Mr. Afenyo-Markin argued.

The Minority Leader further challenged the Finance Minister’s approach, accusing him of sidestepping procedural norms and misleading the public by suggesting the levy would have no financial impact.

“What is Energy Sector Levy, short form? E-Levy. Energy starts with ‘E’. The Hansard is watching, and one day, this precedent will come back to haunt you.”

Parliamentary Clarifications

The First Deputy Speaker, Bernard Ahiafor, intervened to clarify that the current bill is not the same as the repealed Electronic Transactions Levy, noting its different scope and structure.

Majority Leader, Mahama Ayariga, also weighed in, defending the bill as a practical solution to the country’s persistent power challenges.

“It is not E-Levy. This bill simply asks Ghanaians to contribute GH¢1 per litre of fuel to help end dumsor. We all have a part to play in fixing the power sector,” Mr. Ayariga said.

The bill was referred to the relevant parliamentary committee for review, and was expected to be passed at the time of filing this report.

By Ernest Kofi Adu, Parliament House