Contrary to the claims that the Electronic Transaction Levy Bill commonly called (E-levey) will be put before Parliament next month, it will rather be tabled Friday, January 28, 2022, information gathered by DGN Online indicates.

The move is to ensure that the Bill is taken when the Speaker, Alban Kingsford Sumana Bagbin is presiding.

Mr. Bagbin is set to leave the country this weekend for Dubai in the United Arab Emirates (UAE) for another medical review without any concrete time he might return.

Consequently, he will not be available for some weeks from next week thereby, leaving one of his deputies to preside over the House, with its implications on voting rights.

Late last year, an attempt by the First Deputy Speaker, Joseph Osei Owusu, who was then presiding, to vote on issues relating to the E-Levy led to a brawl and fisticuffs in the House, forcing Parliament to adjourn, without passing the Bill.

Already, the Majority Leader in Parliament, Osei Kyei Mensah Bonsu is urging all Members of Parliament to make themselves available to partake in the process leading to the passage of the E-levy.

He told the House on Tuesday January 25, 2022 that further stakeholder consultation are ongoing on the proposal hence the inability of the Business Committee to programme it during the first week of the first setting of the second session.

The Suame MP is optimistic the Business Committee will programme the proposal after the engagement.

“Mr Speaker, as Honourable members will recall the House was expected to conclude consideration and passing of the electronic transfer levy bill 2021 by the end of the third meeting for the first session.

“Due to unforeseen circumstances however, the House was unable to consider and pass the bill at the end of of the meeting. It was therefore the contemplation of the Business Committee that the Bill will be scheduled for consideration by the House during the First week of the first meeting of the second session.

“However upon consultation with the sponsoring Minister the committee is not unable to programme same for this week after resumption.

“The Honorable Minister of Finance has been undertaking further engagements with stakeholders and sections of the general public with respect of some concerns that have been raised on the bill.

“The committee, in all probability, will programme the bill for consideration in the second week of this meeting and honorable members are therefore encouraged to participate fully in the consideration and the process of the passage of the bill,” he said when explaining the absence of the E-levy proposal on the Order Paper.

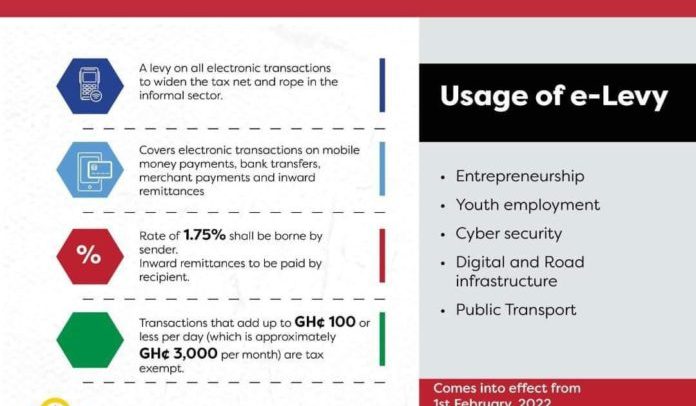

In the 2022 Economic and Financial Budget Statement of the government, the Finance Minister announced a new levy to be charged on all electronic transactions to widen the tax net and rope in the informal sector.

He stated in Parliament that “It is becoming clear there exists enormous potential to increase tax revenues by bringing into the tax bracket, transactions that could be best defined as being undertaken in the ‘informal economy’,” Mr Ofori-Atta observed on Wednesday, November 17 as he presented the 2022 budget statement in Parliament.

“After considerable deliberations, government has decided to place a levy on all electronic transactions to widen the tax net and rope in the informal sector. This shall be known as the ‘Electronic Transaction Levy or E-Levy’.”

Giving further details, he explained that the new E-levy will be a 1.75 per cent charge on all electronic transactions covering mobile money payments, bank transfers, merchant payments and inward remittances to be borne by the sender except inward remittances, which will be borne by the recipient.

Touching on how the charges will be done, the Finance Minister indicated that it will however, not affect transactions that add up to GH¢100 pr less per day.

“A portion of the proceeds from the E-Levy will be used to support entrepreneurship, youth employment, cyber security, digital and road infrastructure among others,” he said when mentioning what the proceeds from the levy will be used for.

The new levy was scheduled to start Saturday, January 1, 2022 but the passage of the bill has been characterised with several challenges as the house is devided.

By Vincent Kubi