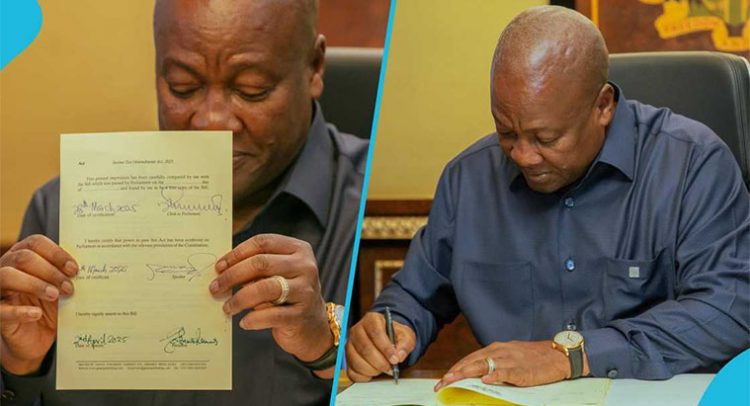

President John Mahama after assenting to the bill

Introduction

Ghana has witnessed two instances of the abolition of tax on lottery winnings – first in 2017 and more recently in 2025- and in both cases, the process appears to have been marked by legislative challenges.

The recent repeal of the withholding tax on lottery winnings commonly referred to as the “betting tax” sparked widespread excitement among lottery participants. Yet, beneath the celebrations lies a nuanced legal and fiscal question: has the repeal abolished taxes on lottery winnings entirely, or solely removing the withholding obligation at payout? In 2017, betting tax was abolished under the Income Tax Amendments (No.2) Act, 2017 (Act 956). It was reintroduced in 2023 under the Income Tax (Amendment) Act, 2023 (Act 1094). Subsequently, in March 2025, the Income Tax (Amendment) Act, 2025 (Act 1129) was passed to abolish it again. The question is, has the betting tax been properly abolished, or is it merely a drafting issue in both the 2017 and 2025 Acts? Is income from betting, taxed elsewhere within the tax laws even though it is deleted from the list of items classified as investment income?

From a strictly legal and tax policy perspective, the signed repeal specifically removes the requirement for withholding taxes at the point of payout for lottery winnings. The critical technical distinction to consider is whether this repeal extends beyond withholding obligations to the overall taxability of lottery income under the Income Tax Act. While President’s signature formally ended the withholding tax regime, there remain complex and technical consideration. This article examines whether lottery income remains taxable, either as business income or as isolated transactions, despite the recent repeal.

Lottery and Betting In Ghana – Historical Canvas

Gambling is as old as society itself, and on the colonial Gold Coast, it took many forms, including informal betting houses, underground lottery schemes, and street-corner wagering. In the early days of Ghana’s independence, as the nation was building its legislative identity, it faced a surging challenge of unregulated gambling, and lotteries were spreading rapidly. Yet, these activities benefited unscrupulous operators, threatened to drain the hard-earned resources of ordinary Ghanaians, and deprived the state of valuable revenue streams.

Ghana sought to consolidate its fragmented gambling laws from the colonial rules when two legislative frameworks on lotteries were introduced: the Lotteries Betting Act, 1960 (Act 31) and the National Weekly Lotto Act, 1961 (Act 94). Together, these laws structured how these activities were conducted in Ghana. Act 31 was a robust legislative response aimed at criminalising unauthorised lotteries and regulating gaming activities under strict state oversight. Recognising that lotteries, if well-managed, could serve as a significant revenue source, the National Weekly Lotto Act (Act 94) was passed in 1961, creating a state monopoly over lottery operations. Act 31 firmly declared most lotteries unlawful.

From the early Acts of 1960 and 1961 and subsequent enactments such as the District Weekly Lotto Regulations, 1989 (LI 1482), to the comprehensive reforms in 2006, the National Lotto Act, 2006 (Act 722) was passed, and the Department of National Lotteries (DNL) gained autonomy. It became known as the National Lottery Authority (NLA), with a sole mandate to regulate, supervise, conduct, and manage the National Lotto. As technology advanced and new forms of gaming emerged, The Gaming Act, 2006 (Act 721) was passed.

Taxation of Lottery and Gambling in Ghana

Under Ghana’s Income Tax Act, 2015 (Act 896), taxable income is broadly categorised into three primary sources: Employment income, Business income, and Investment income. Each source is distinctly defined and taxed accordingly. The General rule is that unless an income is specifically exempted under the law, any income accruing to a person will fall under one of these three categories.

Employment Income (Section 4) includes all payments, benefits, or gains arising from an employment relationship, such as salaries, allowances, bonuses, and benefits in kind.

Business Income (Section 5) comprises profits or gains from any trade, profession, or vocation, including sales, fees, asset disposals, and business-related receipts.

Investment Income (Section 6) refers to returns generated from holding or investing in assets, including dividends, interest, rent, royalties, and lottery winnings.

Thus, since 2015, Ghana has recognised lottery winnings as an investment. A country’s tax system choice strongly influences the inclusion of lottery or gambling income. For countries with a worldwide nature of their tax system, gambling winnings are, in principle, subject to tax whether they arise from windfall (occasional transactions) or a professional gambler.

The Tax base is only on the winnings. Losses incurred in gambling are not deductible because each gambling occasion is a separate event, so gambling losses arising on one occasion cannot be deducted against gambling winnings derived on another occasion. These restrictions presumably reflect administrative difficulties of verifying gambling losses.Even in the case of a professional gambler, gambling losses for the year can be deducted only to the extent of gambling income.

Most countries tax lottery or Gambling income as occasional income (a windfall), and some countries consider gambling income taxable only if the gambler can be found to be in the business of gambling. For example, in Germany, the gambling income of a professional card player is taxable as business income, while gambling income from TV shows is taxable as other income.

When Act 896 was passed, lottery winnings were taxed at a withholding rate of 5% on the winning amount under 1st Schedule Par 8(1)(b)(viii). Regulation 24 of the Income Tax Regulations, 2016 (L.I. 2244), defines winnings from lottery to include gaming, betting, and any game of chance.

In 2016, the Income Tax Amendment Act, 2016 (Act 907), exempted the first GHS 2,592, and any excess winnings exceeding this amount were taxable at a withholding rate of 5%. In 2017, the National Lottery Authority (NLA) submitted a proposal to the government for the scrapping of taxes as a means of attracting more mainstream operators, leading to the passage of the Income Tax Amendments (No. 2) Act, 2017 (Act 956). Act 956 provided as follows: “ Section 6 of Act 896 amended: The Income Tax Act, 2015 (Act 896) referred to in this Act as the principal enactment is amended in section 6 by the deletion of subparagraph (iv) of paragraph (a) of subsection (2)”. The amendment sought to delete from the list of items classified as investment income under Section 6.

By: Francis Timore Boi Esq [ftimoregh@gmail.com]

The writer is a Tax Consultant and a member of the Chartered Institute of Taxation Ghana