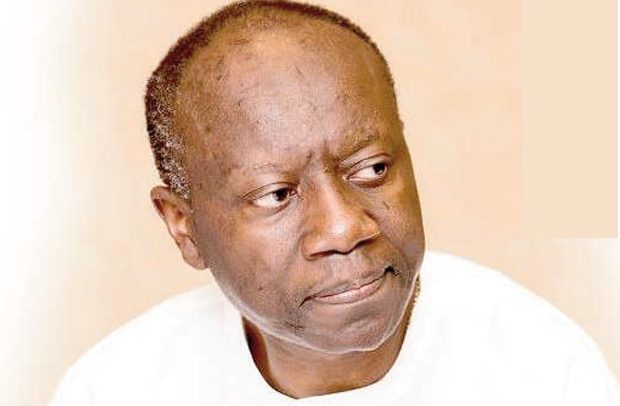

Ken Ofori-Atta

Finance Minister-designate Ken Ofori-Atta has fired back, insisting that “I don’t think that we broke any rules” regarding the procurement processes on the controversial Agyapa Royalties deal.

He said Special Prosecutor Martin Amidu, who resigned late last year, citing the Agyapa deal as one of his reasons, did a great disservice to the country by not taking his side of the story but was able to conclude that there was corruption in the whole transaction.

“I think, really, there’s quite a bit of cynicism about that transaction, and for me, for the House, for such a report to be put out in public without us or myself, as Minister of Finance, having a chance to discuss it, I think it’s a disservice to our democracy; and that is such a fundamental right that I think we all, as a people, should be careful about,” he told the Appointments Committee of Parliament during his rescheduled vetting yesterday.

The minister-designate should have been vetted late last month but had to travel to the United States due to complications he suffered for his post-Covid-19 treatment, and managed to take his turn yesterday.

Agyapa Legality

He said Agyapa, as a Special Purpose Vehicle (SPV), set up by the Minerals Income Investment Fund Act, 2018 Act 978 and passed by Parliament, “I do not feel that we broke any rule and I think the Attorney General will be able to give you a firm assessment of that;” adding, “I think such conjectures are inimical to growth and it does not help the kind of freedom, policy orientation and innovation that we require for this country to grow.”

The minister-designate noted that the government had good intentions towards leveraging the country’s mineral resources to raise equity to fund the transformation of the country; adding that if Parliament was able to give him the mandate to raise $2 to $3 billion bonds with all the risks associated, then he did not see why the Agyapa deal should not be looked at again.

“We should also note beyond that and the reason I brought the Act out, because the Act was well-debated and put into motion. I think risks are part of every investment that you make, and Parliament gives me the onus mandate to go and raise bonds – $2 billion and $3 billion with all sorts of risks – and, so far, these three years, we have brought the best pricing under what comparable countries can enjoy,” he said.

Resubmitting Deal

Mr. Ofori-Atta indicated that the Agyapa transaction would be resubmitted to Parliament as suggested by President Akufo-Addo where all the issues would be opened, saying, “We will resubmit it to Parliament.”

“The question, in this new normal, is what we do to leverage our natural resources. I hope we all come to terms with how we will capitalize and grow our transformation,” he said.

“We are looking to inject equity into the way in which the country grows, but if you look at the powers of the fund which this august House passed, Act 978, the fund may create and hold equity interest with the SPV, procuring the listing of the SPV in a reputable stock exchange assigned,” he said.

Databank

The involvement of Databank, a reputable financial institution formed by the minister and his partners many years ago, in the Agyapa deal surfaced at the vetting of the minister-designate.

“In my situation, I truly do not engage in these procurements and transactions, as we think broadly on the economic freedom space for people, our international relationship to make sure that we get the best people. So, I can give you my commitment. Certainly, I have not been on the boards of Databank since 2012, 2014, I had retired from that. I think we built two great companies,” he said.

In his view, the attractiveness of Databank is what has earned it places in government’s financial transactions for the past 14 years, saying, “I know that in my capacity as a public service official, who has been a director and co-owner of that company, I was not part of any decision-making with regard to that.”

1st Class Service

“But I think we should be having, truly, a broader discussion about Ghanaian enterprise and, therefore, how independent and experienced entrepreneurs can join government at any point in time,” he said.

“I don’t think there wasn’t any conflict of interest straight away, because I was not part of the decision. I think the first-class nature of that institution speaks for itself and the Ghanaian entrepreneurial ingenuity that has brought it this far, must be praised and we should be encouraging our companies to grow so that we can begin to do the Eurobonds ourselves,” Mr. Ofori-Atta told the committee.

Govt on Course

According to him, the government was on the right course, but pointed out that the challenge was that “the new normal seems to be quite a bit of a debt for all countries. What do we do with our natural resource to leverage it into equity; this is the question that we have to face.”

“As to how that is mobilized and the issues we will contend with are the reasons the President wants us to submit it again, for the issues around it to be resolved. I think philosophically we are going to come into terms with the reality of diversifying how we capitalize and fund our transformation, which we intend to do,” he argued.

The nominee said the Finance Ministry has launched the roadshow for $5.5 billion and had also begun the issue of a major economic planning as a setup of Obaatan Pa.

Public Debt

On public debt, Mr. Ofori-Atta said everybody was familiar with the situation in terms of it moving from GH¢122 billion to GH¢292 billion, and intimated that what was in contention was the way the government categorized the financial service sector and the energy sector, which he stated, identified in the books but not added to the public stock.

“There has been a lot of philosophical debate as to how to accommodate that. Our sense is that we are close to the completion of financing both the asset management companies and the banking system, and therefore we should, by the end of the third quarter or end of year, have those numbers complete so that we can add them on.”

“In addition, there seems to be a new normal in the world. African debt has moved from 34 per cent to 56 per cent. We are beginning to equalize that standard for that period, and I think that is where we are leading to,” he stated.

On the issue of misclassification, Mr. Ofori-Atta intimated that “we are making a mountain out of a mole hill. The fact of the matter is that when you read the fiscals you will know what the added liabilities are, and that there is a fact.”

“We are beginning the issue of appropriation and preparing for this vetting. For someone who works 18 odd hours since 2017, I just see and know what we have to do. I can assure you the enthusiasm is there, the strength is there and the excitement for the future has since continued,” he said.

Aid with Conditions

The Finance Minister-designate said the Akufo-Addo-led government would not accept any financial aid from other countries on the condition of legalizing LGBT+ activities.

“First of all, I am not clear that it is being established as conditionality…truly, for example, if you look at the decision the President took with regard to the termination of the PDS deal in which $190 million, therefore, had to be left on the table.

“I think our sociology and our traditions are the most important enduring legacy that we have and, so, we will make decisions that suit our Ghanaian purpose so that we can develop in the way we want to develop,” he said.

God’s Hand

The minister expressed gratitude to his family and Ghanaians for their prayers and outpouring of love shown him during his ill-health, and said “God’s hand” healed him.

“God’s hand is true, visible in my recovery. I thank all Ghanaians for offering intercessory prayers and fasting in my recovery,” he said.

He said he was fit to work, adding “I think public service is a duty that has its own energy and passion, and let me assure the chairman that there will be no laxity in the intensity of the work that we have to do.”

By Ernest Kofi Adu, Parliament House