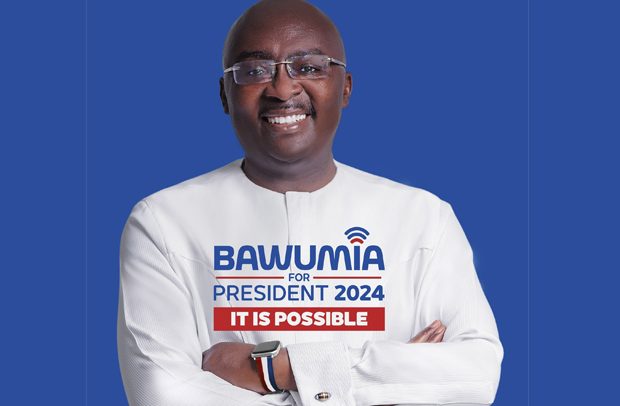

Dr. Mahamudu Bawumia

Vice President and flagbearer of ruling New Patriotic Party (NPP), Dr. Mahamudu Bawumia dazzled Ghanaians when he outlines his vision for Ghanaians and the nation as a whole.

The presidential hopeful delivered his speech by giving hope for Ghanaians to save their taxes by aiming for a lean government with at most 50 ministers among others policies.

Most Ghanaians were impressed with the brilliance of the Vice President’s vision for the nation, dubbed as the new chapter for Ghana.

Speaking at the UPSA auditorium, Dr. Bawumia promised a number of things – including removing ‘controversial taxes’ that the administration he serves under has implemented, while also applauding the government’s handling of the economic crisis.

The NPP Flagbearer, has outlined his vision to the party and the public in what he termed as the ‘Bold Solution for the Future’ for his next government should he be handed the mandate to lead the country in 2025.

In an event attended by the rank and file of the party and government, members of the diplomatic corps, Dr. Bawumia expressed gratitude to President Nana Addo Dankwa Akufo-Addo for the strong faith and belief he had for him to choose him as a working partner, thereby building an enviable governmental legacy.

According to him, his vision is to create a tent big enough to accommodate all our people, to tap into the resourcefulness and talents of our people irrespective of our different ethnic, political, and religious backgrounds, to channel our energies into building the kind of country that assures a food self-sufficient, safe, prosperous, and dignified future for all Ghanaians, to create sustainable jobs with meaningful pay for all, and for Ghana to participate fully in the fourth industrial revolution using systems and data.

In order to realize these visions, Dr. Bawumia emphasized on the need to build and nurture the mindset of possibilities. He said the country needs to invigorate the can-do spirit of the Ghanaian to believe that we can even do better than we ever imagined if we put our minds to it.

The visions as he presented to the public lay more emphasis on attaining sustainable macroeconomic stability, the introduction of a new tax system, building a digital economy and making Ghana a digital hub, reducing the cost of living, Power sector reform, and maximization of the benefits from natural resources.

The rest includes Industrialization for jobs, Fighting corruption using digitization and a cashless society, development of a credit system for Ghana, having a national development plan, Constitutional review, Collaboration with faith-based organizations, Tourism, Sports, and Creative Arts, Care for the vulnerable and special needs, and additional priorities.

He announced his intentions to make significant changes to the National Service scheme and tax system if elected as President.

He proposed that individuals who secure employment after completing their education should be exempted from National Service.

“Ladies and gentlemen, to assist our youth in securing jobs, it is time to reevaluate our current National Service scheme. My government will suggest that those who can secure employment after completing their education be exempted from National Service,” Bawumia declared.

Furthermore, Bawumia highlighted the importance of simplifying the tax system and creating a business-friendly environment.

He pledged to introduce a flat tax regime that is easy to understand and implement for individuals and Small and Medium Enterprises (SMEs).

The flat tax would be a percentage of income, with exemption thresholds in place to protect low-income earners.

“With the introduction of the new tax regime, completing the tax return should take only minutes! We will also simplify the complex corporate tax system and VAT regime,” Bawumia added.

In addition to the proposed changes to the tax system, Bawumia unequivocally stated his opposition to the tax on electronic financial transactions, commonly known as the e-levy. Introduced in 2022, this tax has been a subject of heated debate.

Bawumia affirmed that if elected as President, he would abolish the e-levy.

“To promote a digital and cashless economy, we must encourage the use of electronic payment channels. To achieve this, my administration will not impose taxes on digital payments. Therefore, the e-levy will be abolished,” Bawumia declared.

As part of his new tax regime, Bawumia also plans to abolish the emission tax, tax on betting, and the proposed 15% VAT on electricity tariffs, if it is in existence by January 2025.

By Vincent Kubi