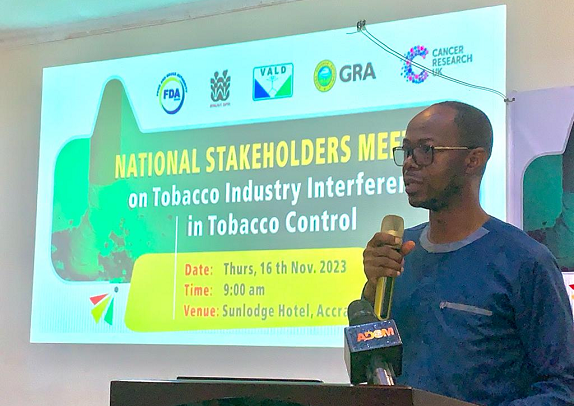

Labram Musah

The Ministry of Health has been urged to collaborate extensively with CSOs and other stakeholders to draft a code of conduct to govern how public officials interact with the tobacco businesses.

Executive Director, VALD Ghana, Labram Musah, who made the call, said the code of conduct was necessary to limit the high interference of Tobaccos businesses in the country’s tobacco control programmes.

Speaking at the National Stakeholders Meeting on Tobacco Control, Mr. Musah indicated that Ghana scored 58 in the 2023 Tobacco Industry Interference Index which represents a high interference from the Tobacco industry.

In 2020 the country scored 58 and saw an improvement in 2021 with 56 points but it went up again by two points in 2023.

“We recommend that the government ban all tobacco-related corporate social responsibility (CSR) activities and direct the tobacco industry to publicly report or declare its CSR initiatives in the country,” Mr. Musah said.

He further noted that government officials should be mandated to publicly share information on their dealings with the tobacco industry on platforms like their websites.

“Tobacco Control Inter-Agency Coordinating Committee must place a high priority on surveillance and monitoring of tobacco industry operations nationwide,” he added.

Senior Inspector of Taxes at the Ghana Revenue Authority (GRA), Dr. Alex Kombat, revealed that the country spends an estimated GH¢ 668 million annually, equivalent to 0.2% of the country’s GDP, to address the consequences of tobacco-related illnesses.

He therefore emphasized the urgent need for measures to curb tobacco consumption, citing the addictive nature of these products as a key driver of their widespread use.

Recognizing the economic and public health implications, the government, in collaboration with the Ghana Revenue Authority (GRA), has implemented tax measures to increase the prices of tobacco products, discouraging large-scale consumption.

These measures, including excise taxes, customs duties, value-added tax (VAT), National Health Insurance Levy (NHIL), and others, have been employed both at entry points into the country and domestically to dissuade tobacco use.

Dr. Kombat revealed that tobacco excise tax revenue has experienced substantial growth, from GH¢66.98 million in 2017 to GH¢176.44 million in 2022, growing at an average rate of 29% annually.

Head of Tobacco Products at the Food and Drugs Authority (FDA), Jemima Odonkor, highlighted the relentless interference of the tobacco industry in Ghana’s progress in tobacco control.

She underscored the need to monitor industry tactics to protect public health policies, citing the WHO’s recognition of this as essential for safeguarding public health.

By Jamila Akweley Okertchiri