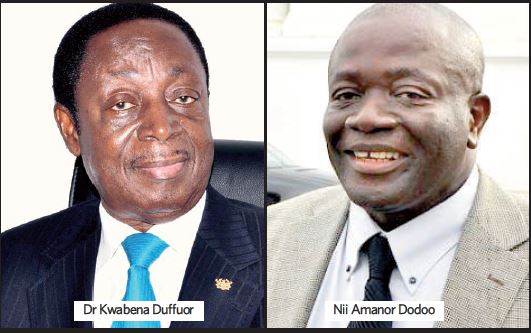

Defunct uniBan, placed under the receivership of Nii Amanor Dodoo by the Bank of Ghana, has sued the founder of the private bank, Dr. Kwabena Duffour, his companies and some other shareholders over circumstances leading to the collapse of the bank.

Filed before an Accra High Court, the suit is seeking an order for the 10 defendants to cough up GH¢5.712 billion which was allegedly misappropriated by them and persons related or connected to them.

The other defendants in the matter include Dr. Kwabena Duffuor II, Ekow Nyarko Dadzie-Dennis, Boatemaa Kakra Duffuor and Starlife Insurance.

The rest are Hoda Holdings Limited, Hoda Properties Limited, Integrated Properties, Alban Logistics Limited and Bolton Portfolio Limited.

The suit alleges that the plaintiffs, while in charge of the bank which became insolvent leading to the takeover by the Central Bank, used their control over the bank to cause the execution of over 1,000 separate transactions for their own benefits and persons related to them.

It further averred that as at May 2018, the shareholders and persons related to them owed the defunct bank approximately GH¢4.97 billion which later rose to GH¢5.712 billion as a result of loans and advances obtained by the shareholders and persons related or connected to them.

The suit also averred that the loans and grants advanced the shareholders and their relatives were unlawful, as they were made in breach of applicable laws, including Act 673 and Act 930.

“The transactions did not comply with the plaintiff’s (uniBank’s) internal procedures and approval requirements. The transactions constituted in many cases, the unlawful return of the plaintiff’s assets to the shareholders,” the suit averred.

Liquidity Support

The suit also accused some of the shareholders of the defunct bank of “siphoning” the bank’s funds leading to the bank depending significantly on liquidity support from the BoG from 2015.

It said despite the financial situation of the bank caused by the actions, the defendants, specifically Dr. Kwabena Duffuor II and Ekow Nyarko Dadzie-Dennis presented “inaccurate information to the BoG and the public over the years to create the impression that the plaintiff (uniBank) was in good financial health, while insiders and related parties continued to siphon money from the plaintiff.”

Fresh Suit

The fresh suit follows the dismissal of an earlier one filed the Receiver as the court held that he did not have the capacity to sue in his personal capacity.

The High Court, in dismissing the case, had ruled that Mr. Amanor Dodoo did not have the capacity to issue a writ in his own name in the manner that it was done.

The Receiver had sued Dr. Duffuor and 16 others to pay GH¢5,712,623,145 which was allegedly misappropriated.

In a suit filed at an Accra High Court, Mr. Amanor Dodoo, who is a senior partner at KPMG, was seeking an order of the court against Dr. Duffuor and 16 others with links to the defunct bank to repay the huge amount of money.

The presiding judge, Justice Jenifer Dadzie, dismissed the case and an injunction which had stalled the arbitration process, being presided over by former Supreme Court judge, Dr. Justice Dateh-Baah.

Reliefs

Mr. Amanor Dodoo, in his new writ, is once again seeking an order on the 10 defendants to cough up GH¢5,712,623,145 “unlawfully taken from the plaintiff, after the deduction of the amounts used to acquire the properties and assets which would be transferred and/or returned to the plaintiff.

It is also seeking an order on the defendants to transfer or return to the defunct bank within 15 days after the judgment of the court some 76 properties and assets acquired with funds taken illegally from the bank.

It also wants a declaration that all the properties and assets identified to have been acquired with funds unlawfully taken from the bank are held in trust for the bank.

Again, the writ wants an interest at the prevailing interest rate on the GH¢5,712,623,145 from the date it became due till the date of the final payment.

BY Gibril Abdul Razak