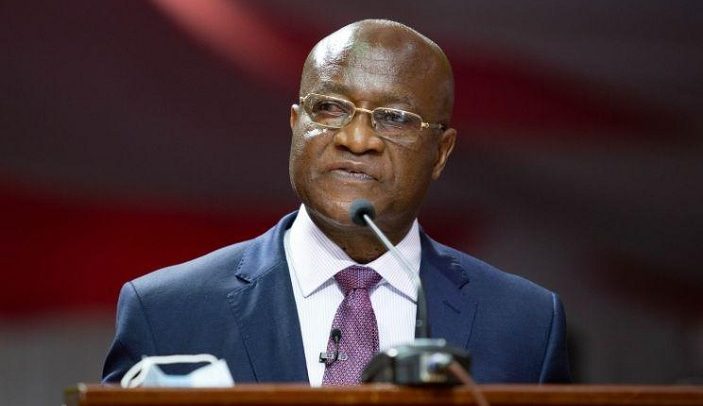

Osei Kyei Mensah Bonsu

THE new domestic revenue mobilisation laws, which received the backing of Members of Parliament (MPs) over the course of two days in separate marathon parliamentary votes, are expected to generate GH¢4 billion in revenue for the country in each year.

The Excise Tax Stamp (Amendment) Bill, Excise Duty (Amendment), Income Tax (Amendment) (No.2) Bill, and Growth & Sustainability Levy Bill were approved by the House by a majority of 137 to 136.

Members of the Majority Caucus voted in favour of the bills, including Nanton lawmaker Mohammed Hardi Tuferi, who was involved in an accident prior to voting, while all members of the Minority Caucus voted against them.

The passage of the bills was required for Ghana to obtain board-level agreement for the International Monetary Fund (IMF) programme.

The bills will increase some income taxes, company taxes, and the excise duty on cigarettes and various alcoholic and sweetened beverages.

The Excise Duty (Amendment) Bill in particular is anticipated to generate GH¢400 million per year and it will impose a 20 per cent tax on e-smoking, and fruit juices among others, whereas the Income Tax (Amendment) Bill, 2022, is expected to rake in GH¢1.2 billion annually.

The Growth and Sustainability (Amendment) Bill, 2022, will levy a 5 per cent levy on profit before tax on businesses, in anticipation to raise GH¢2.2 billion for the national coffers each year.

A rebellion was brewing in the House over supporting the bills, which came after the opposition National Democratic Congress (NDC) leadership told Minority MPs to vote against the tax bills needed for the IMF programme.

The party was demanding that the ruling NPP first allow the Electoral Commission (EC) to include the guarantor system in its proposed Constitutional Instrument before it would support the bills.

For weeks, the opposition party MPs and pro-government lawmakers were at odds over the passage of the bills, with the NDC planning to seize control of parliamentary business from the government to achieve its demand.

They served notice to vote against the revenue bills in order to derail the IMF deal, which President Akufo-Addo has promised to do in order to help him turn around the economy.

By Ernest Kofi Adu, Parliament House