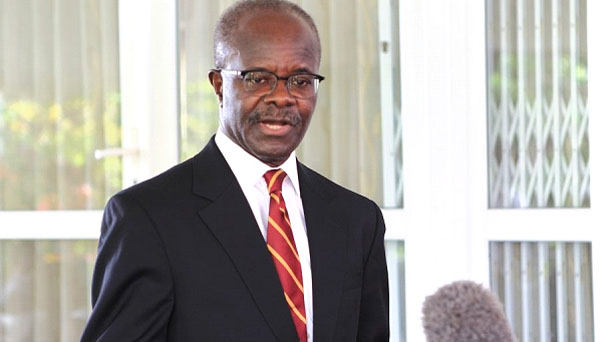

Dr Papa Kwesi Nduom

An Accra High Court has cautioned the Bank of Ghana (BoG) not to undermine the suit filed by Dr. Papa Kwesi Nduom, against it, over the revocation of the operating license of GN Savings and Loans Limited.

According to the court presided over by Justice Koomson, all actions or processes being undertaken by the central bank must be put on hold till the determination of the pending injunction.

The judge further directed lawyers of BoG and the other defendants – Minister of Finance, the Attorney General and Eric Nana Nipah, the central bank’s receiver, to file their responses and legal arguments within eight days.

The case was adjourned to September 19, 2019.

Suit

The Chairman of Groupe Nduom, Dr. Papa Kwesi Nduom, has sued the Bank of Ghana and three others over the revocation of the license of his GN Savings and Loans Company Limited.

The suit which was filed jointly by Coconut Grove Beach Resort and Conference Centre Limited and Groupe Nduom (GN) Limited, is challenging the decision of the central bank to declare GN Savings and Loans Company insolvent leading to the revocation of its operating license.

According to the plaintiff, several government agencies owed them and the BoG cannot turn around to revoke their license.

Reliefs

Among the reliefs being sought by the plaintiff include a declaration that by failing to take into accounts the indebtedness of the government of Ghana and its MDAs to Groupe Nduom, Gold Coast Advisors Limited or GN Bank before concluding that the savings and loans company was insolvent and consequently revoking its specialised deposit-taking licence, violates their rights.

They also want an order of certiorari, quashing the decision in the notice issued by BoG which declared GN Savings and Loans Company insolvent and consequently revoked its licence to operate as a specialised deposit-taking institution.

Again, the suit is seeking an order on BoG to restore to the company its licence to enable it to continue operating as a specialised deposit-taking institution.

It also wants an order on the receiver of the company “to submit the possession, management or control of the assets, operations and other activities of the company to its shareholders or persons who, immediately before August 16, 2019, were in possession, management or control of such assets, operations and activities.”

BY Gibril Abdul Razak