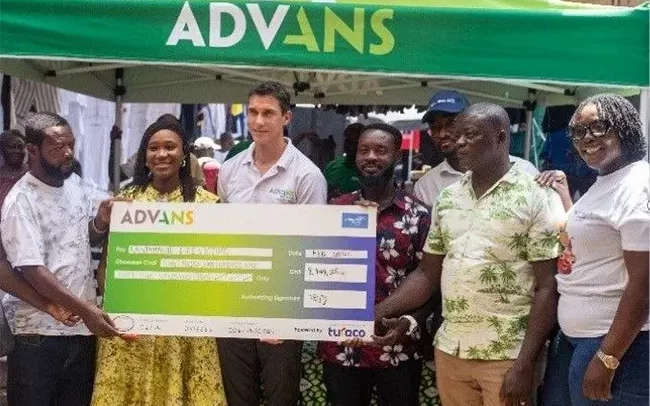

Executives of Advans, Turaco and Enterprise presenting the cheque to the Kantamanto fire victims

Advans Ghana, Turaco Inclusive Ghana (T/A Turaco), and Enterprise Insurance LTD have provided a lifeline to hundreds of small business owners at Kantamanto.

Through their longstanding microinsurance partnership, the partners are providing some 227 SME traders with GH¢8.4 million, clearing outstanding loans and providing immediate cash support to rebuild their businesses and livelihoods.

The funds not only cover outstanding credit obligations with Advans Ghana but also offer critical working capital to help traders restart operations immediately.

“At Advans, we are intentional about embedding insurance into our services so our customers are protected in moments like these. Our partnership with Turaco and Enterprise Insurance is part of that proactive approach to safeguarding livelihoods, and this payout demonstrates the power of building financial resilience in advance,” said Guillaume Valence, Advans Ghana CEO.

“Micro insurance is a customer-centric service that makes it possible for the most vulnerable people to access financial protection when they need it most. This is evident in our partnership with Advans Ghana and Enterprise Insurance. The Kantamanto response shows that strategic partnerships and seamless delivery can turn risk into resilience,” said Leona Abban, General Manager, and Turaco Ghana.

The product, underwritten by Enterprise Insurance LTD Ghana, highlights the importance of robust underwriting partnerships in delivering responsive and impactful micro insurance solutions.

“At Enterprise Insurance, we believe insurance is most impactful when it directly addresses the immediate needs of our customers and communities. Our underwriting support for the Advans-Turaco partnership reflects our commitment to protecting Ghana’s SMEs from unpredictable risks,” said Akosua Ansah-Antwi, Managing Director, Enterprise Insurance LTD.

The success of the Advans-Turaco response has been hailed as a blueprint for scaling financial protection for SMEs across Ghana, with the NIC Deputy Commissioner, Bernard Ohemeng-Baah, representing the Commissioner, praising the model and its impact.

“As a regulator, we see this payout as a demonstration of the role inclusive insurance can play in economic resilience. We will continue to foster regulatory support for innovations that protect small businesses and traders—the backbone of our economy,” he said.

In addition to the insurance payouts, Advans Ghana has provided GH¢20,000 worth of building materials to support traders in rebuilding their stalls, reinforcing its commitment to their customers at Kantamanto.

Advans Ghana also offered select clients a Restart Offer, which entailed a payment grace period and 10percent reduction in interest to help these clients get back on their feet. These initiatives were aimed at supporting their customers’ long-term recovery and stability.

A Business Desk Report