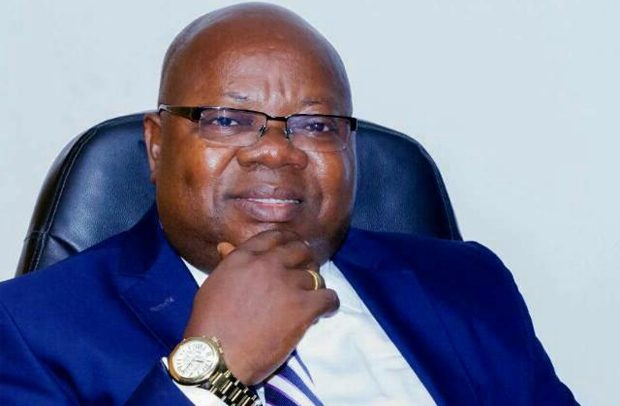

Dr. Kofi Mensah

The Agricultural Development Bank (adb) says it has been able to meet the GH¢400 million minimum capital requirement of the Bank of Ghana (BoG).

The bank’s shareholders authorized the Board of Directors to raise a total of GH¢383 million in fresh and existing capital to enable the bank to meet the Central Bank’s minimum capital requirement.

At an Extraordinary General Meeting (EGM) yesterday in Accra, shareholders of adb also approved a resolution to appoint auditing firm EY as auditors to replace KPMG, which audited the bank’s accounts previously.

Come December 31, 2018, all universal banks operating in the country are supposed to meet the GH¢400 minimum capital requirement of the BoG.

So far, it’s believed that about 19 banks, including Cal Bank, Fidelity Bank, Zenith Bank, have met the minimum capital requirement, with some banks said to be struggling to meet the requirement.

BUSINESS GUIDE gathered that out of adb’s GH¢383 million, a minimum of GH¢233 million is to be raised through a renounceable rights issue.

In its 2017 audit report, adb’s stated capital was pegged at a little over GH¢275 million.

This means that successfully raising GH¢383 million will bring the stated capital of the bank to GH¢658.

Endorsement

According to the Board Chairman of the adb, Alex Benasko, BoG has endorsed the decision by his outfit to convert debt of GH¢150 million to equity shares to help meet the minimum capital requirement.

He stressed that the BoG raised no objection to the move after shareholders’ approval, saying “the most important thing is to get the shareholders’ approval for this move because the Bank of Ghana has given its consent, and awaiting the bank to approve through its shareholders.

The Board Chairman explained that the current ownership structure of the bank would change after all the necessary documentations are done.”

The largest majority shareholder of adb is the Bank of Ghana (BoG), through its representative, the Financial Investment Trust, with 60.5 per cent.

The Government of Ghana has 32.30 per cent and 7.20 per cent for other shareholders.

Managing Director of adb, Dr Kofi Mensah, told journalists that the bank’s vision is to be among the top tier banks in Ghana with focus on agriculture.

According to him, the bank would remain committed to growing a strong customer – centric Bank, while providing profitable and diversified financial services for a sustained contribution to agricultural development and wealth creation.

He was optimistic the new development would offer the bank the opportunity to finance projects and also increase its support for the agricultural sector, adding that “we will be able to expand more and also increase financial support to the agricultural sector which has been our main focus.”

By Melvin Tarlue