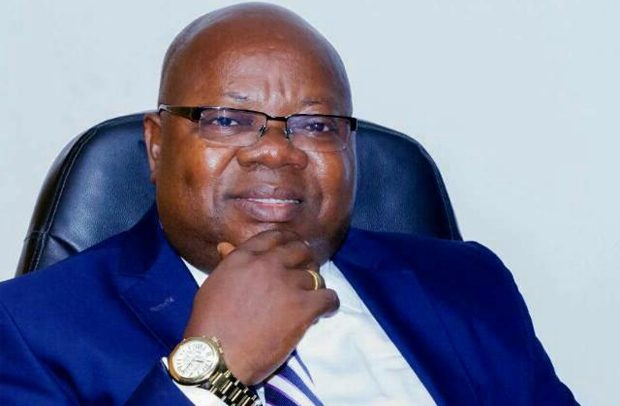

John Kofi Mensah

THE AGRICULTURAL Development Bank (ADB) has rolled out three new digital banking products and services to allow customers transact business and access banking services without necessarily visiting the banking halls.

The new digital banking services include the contactless card and POS device, the web acquiring device and the visa prepaid card.

The contactless card and POS device serves as a faster means of payment, as it accepts MTN Mobile Money, Vodafone Cash and Airteltigo Money. Customers with the POS cards are only required to ‘tap and go’ on their contactless devices to execute low value transactions of GH¢150 and below.

The ‘web acquiring service’ promotes ease of doing business and convenience in making payments by customers to their merchants online.

The visa prepaid card also allows users to load funds up to GH¢45,000 in a month which can be used at any of the 24 million visa ATMs and 120 million point of sale terminals worldwide.

At a digital banking breakfast summit held on Tuesday, July 29 at the Accra City Hotel, Managing Director (MD) of ADB, Dr. John Kofi Mensah, stated that the digital services were rolled out as part of efforts to stay ahead of competition to win more customers.

“The introduction of these products and services are aimed at offering our cherished customers the best digital banking services for speed, reliability and safety,” he said.

He added that the new services and products are not only available to individual customers but also to corporate institutions who wish to enjoy safe and convenient banking in the comfort of their offices.

Besides, the bank has re-introduced its executive banking service to provide unique, fast, superior and personal banking solutions in the best and most convenient ways to its customers.

By Nii Adjei Mensahfio