Godfred Yeboah Dame

The Attorney General and Minister of Justice, Godfred Yeboah Dame has served notice to government of not taking unilateral debt exchange programme.

According to the AG, domestic bondholders should be engaged before any such move since taking mandatory debt exchange programme would be illegal.

Finance Minister, Ken Ofori-Atta announced domestic bondholders with the exception of Treasury bill holders will be affected by the debt exchange programme.

Per the arrangement, bond holders will get 0 percent interest in 2023, 5 percent in 2024 and 10 percent onwards. The bonds will also be redeemed in 3 instalments within 10 years.

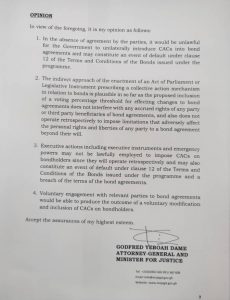

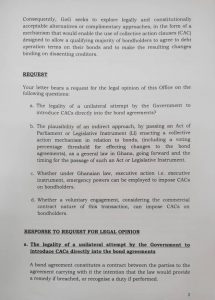

According to a legal opinion document emanating from the Office of the Attorney General, signed by the AG, he advised against any unilateral variation of collective agreement clauses, (CAC).

The AG in his legal advice to the finance minister asked for domestic bondholders to be engaged before any such move because the debt exchange programme can at best be voluntary given the legal ramifications.

“In the absence of an agreement with parties, it would be unlawful for the government to unilaterally introduce CACs into bond agreements and may constitute an event of default under clause 12 of terms and conditions of the bond issued under the programme” Mr. Dame posited in his legal advice to government.

He stressed that “Voluntary engagement with parties to bond agreements would be able to produce the outcome of a voluntary modification and inclusion of CACs on bondholders.”

Read full copy the legal opinion of the AG on the debt exchange program below:

By Vincent Kubi