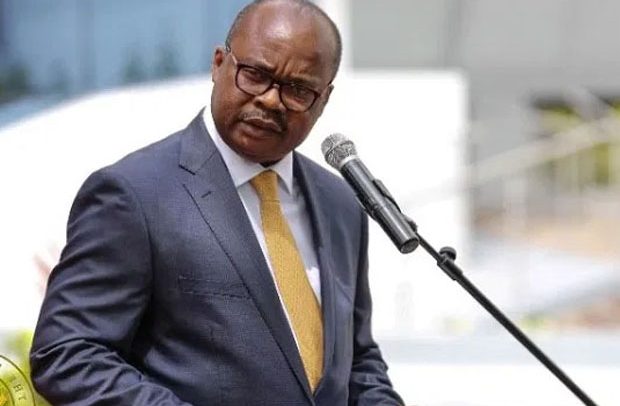

Dr. Ernest Addison

The Bank of Ghana (BoG) has said there has been a strong rebound in both consumer and business sentiments, reflective of the signs of economic recovery.

According to the central bank, its latest surveys conducted in December 2023 showed that consumer confidence improved on account of easing inflationary pressures which led to optimism about future economic conditions.

Similarly, business confidence increased significantly, signalling improvement in consumer demand, as firms met short-term targets and expressed positive sentiments about company and industry prospects.

The survey findings were broadly aligned with observed trends in Ghana’s Purchasing Managers’ Index (PMI), which improved to 51.8 in December 2023 from 51.6 in the previous month.

Dr. Ernest Addison, BoG Governor, addressing financial journalists in Accra, said the disinflation process, which began earlier in the year, continued through to the last quarter of the year supported by strong policies, relative exchange rate stability, and effective liquidity sterilization efforts.

Headline inflation sharply decelerated to 23.2 percent in December 2023, from a peak of 54.1 percent at the end of December 2022.

“The decline in inflation was driven by both easing food and non-food prices.

Food inflation decelerated sharply to 28.7 percent in December 2023 from 59.7 percent in December 2022, while non-food inflation also fell to 18.7 percent from 49.9 percent over the same comparative period.

He said core inflation had also eased significantly, affirming broad decline in prices.

“At home there is gradual recovery in economic activity, though growth remains below potential.

The latest Ghana Statistical Service data showed an expansion in the overall real GDP by an annual rate of 2.0 percent driven by the services and agriculture sectors during the third quarter of 2023, relative to 2.7 percent over the same period in 2022.

“Non-oil GDP growth moderated to 2.1 percent from 3.3 percent over the same comparative period,” he noted.

The BoG Governor continued that the bank’s high frequency real sector indicators pointed to a significant pickup in activity.

“The updated Composite Index of Economic Activity (CIEA) rebounded strongly with an annual growth of 9.6 percent in November 2023 – the highest in two years – from a contraction of 6.2 percent a year earlier.

“Domestic VAT, port activity, industrial consumption of electricity, imports, and tourist arrivals all contributed to the improvement in economic activity observed during the period,” Dr. Addison said.

He added that the bank’s core inflation measure, which excludes energy and utility, more than halved to 24.2 percent in December 2023, down from 53.2 percent in December 2022.

Similarly, inflation expectations by the banking sector, businesses, and consumers have declined.

“Fiscal policy implementation was broadly aligned with requirements under the IMF ECF-supported programme.

“Provisional data shows that the performance criteria target on the primary fiscal balance on a commitment basis, non-accumulation of external debt payment arrears, no new collateralised debt by central government and public entities, all of which are broadly on course for attainment.

“Fiscal performance based on provisional banking data on budget execution for January to December 2023 shows a deficit of around 3.0 percent of GDP, against a target of 5.5 percent of GDP,” Dr. Addison stressed.

By Samuel Boadi