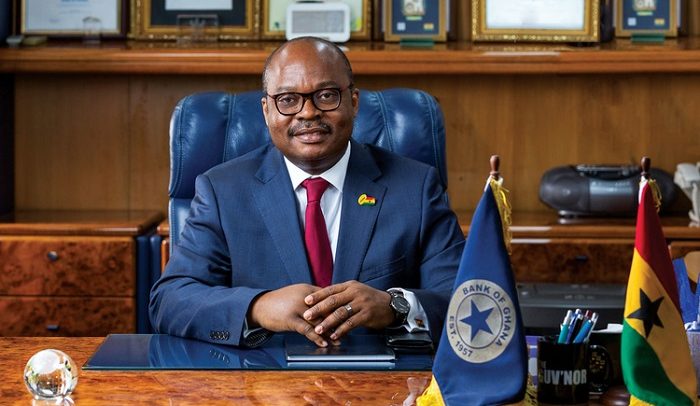

Dr. Ernest Addison, Governor of Bank of Ghana

THE BANK of Ghana (BoG) says more people resorted to the use of digital payments than ever before during the partial lockdown of Tema, Accra and Greater Kumasi as a result of the coronavirus (Covid-19) outbreak in the country.

The BoG Governor, Dr. Ernest Addison, stated that the convenience offered by technology relegated cash and checks, more to the periphery with Covid-19, hastened the decline in the use of cash as the central bank looks forward for people to make a long-term switch to digital payments.

Addressing the Monetary Policy Committee (MPC) meeting last Friday, Dr. Addison disclosed that the general economic uncertainty reduced demand for credit with commercial banks tightening credit stance.

“As a result, credit to the private sector remained virtually flat during the period. Broad money supply (M2+) slowed significantly to 13.5 per cent in March 2020, compared with 21.6 per cent growth a year ago,” he added.

According to him, the latest stress tests conducted in April this year suggested that banks were strong and resilient; pointing out this indicated that they are well-positioned to moderate liquidity and credit shocks on the basis of strong capital buffers and high liquidity positions.

The governor said the banks’ capital adequacy ratio was found to be well above the revised regulatory floor of 11.5%.

He, however, said the nonperforming loan (NPL) ratio of the banks went up during the first quarter, and noted that this reflected the impact the Covid-19 pandemic was having on low credit growth and loan loss provision.

“So far, banks are also responding positively to the recently-announced policy initiatives to support the economy by reducing lending rates and supporting credit growth, as well as offering moratoriums on loan repayments to cushion customers,” he asserted.

By Ernest Kofi Adu