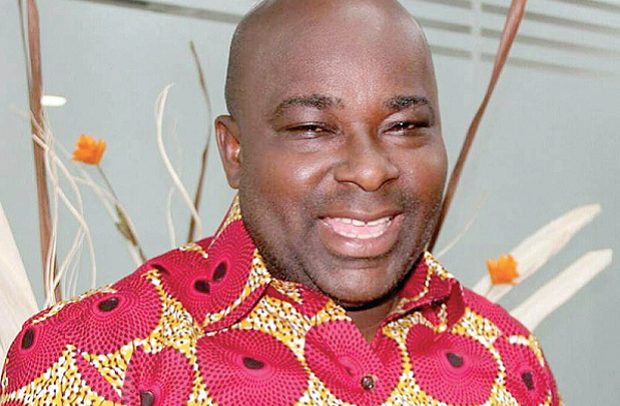

Michael Okyere-Baafi

Micheal Okyere Baafi, Chief Executive Officer (CEO) of the Ghana Free Zones Authority (GFZA), has hinted that his outfit is putting measures in place to review its regulations to make it more investor-friendly.

According to him, the move is in accordance with the Free Zones Law (Act 504, 1995) and Free Zones Regulation (L.I. 1618).

Mr Okyere Baafi said other government institutions like the Ghana Investment Promotion Centre (GIPC) had made amendments.

He said the Free Zones regulations have not been reviewed over the past 20 years.

“We think the Act has become outmoded and we need to make it relevant to modern day business.”

He said the amendment would motivate people who transact business with the Free Zones Authority.

“It is not just about having institutions of government operating and being a one-stop-shop to serve its customers, but we should be relevant to the time and be an institution that is ready to do business not only in Ghana but beyond our jurisdiction.”

To this end, he said all Chief Executive Officers (CEOs) of Free Zones enterprises in the country have been directed to fully comply with the Free Zones Act in their dealings.

The CEO, who made this known an interview with BUSINESS GUIDE, said a new unit, which has been set up to monitor the activities of free zones enterprises, would be the policing wing of its secretariat in the Ashanti Region to ensure the smooth operations of the enterprises.

He added that the Free Zones Authority (GFZA) was working to provide incentives to help create viable and sustainable business environment to attract new investors into the free zone enclaves and support the growth of existing ones.

He added that the IT Unit of the Authority had been expanded and transformed into a Management Information System (MIS).

The CEO revealed that the mission of the authority is to help position Ghana as a gateway to West Africa.

Mr Baafi said some of the identifiable priority sectors are agro-food processing, seafood processing, pharmaceuticals, metal fabrication, jewellery and craft production.

“Aside the 100 percent duty-free on all imports and exports by companies operating under the free zones, operators go through minimal customs formalities at the ports,” he underscored.

He, however, said that investors in the free zones enclaves would pay not more than 15 percent as tax on their profits after the expiry of the 10-year tax free moratorium granted by the government.

By Daniel Bampoe