From July 1, banks in the country would only recognize the Ghana Card as a form of identification for all transactions.

Aside from banks, other relevant institutions like specialised deposit-taking institutions, non-Deposit-Taking financial institutions, payment service providers, and dedicated electronic money issuers; forex bureaus, and credit reference bureaus would also require the Ghana Card for transactions.

A statement issued on Wednesday, January 19, 2022, by the Bank of Ghana, urged all regulated financial institutions to take steps to update customer records with the Ghana Card.

According to the statement, the directive is in line with section 30 of the Anti-Money Laundering Act, 2020 (Act 1044) and Regulation 12 of the Anti-Money Laundering Regulations, 2011 (L.I. 1987).

The central bank also urged customers of regulated financial institutions to update their records with their respective financial institutions with the Ghana Card in line with this notice.

The statement explained that the National Identification Authority verification transaction platform will be integrated into the Bank of Ghana’s financial monitoring platform.

“This is to ensure that all financial transactions performed within the ecosystem are linked to one identity and information, and unique codes for the transactions shared with the Bank of Ghana (BoG) to facilitate the identification of initiators/beneficiaries for track and trace purposes.”

The Bank of Ghana said this would cover transactions by banks, non-bank financial institutions, and mobile money operators.

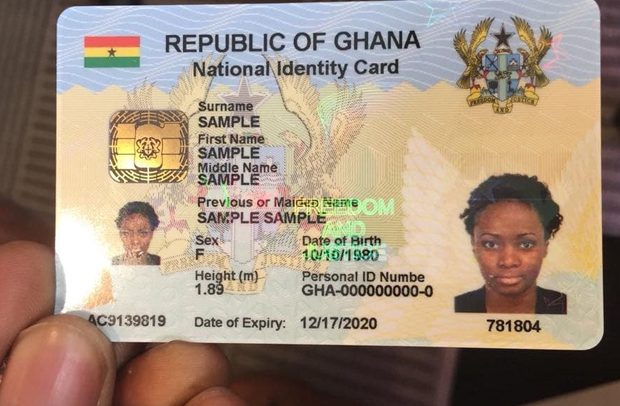

The government is working to make the Ghana Card the core document for identification in Ghana.

It is currently being used as the document required for the re-registration of SIM cards and for government services like Passports, as well as being merged with Social Security and National Insurance Trust.

By Jamila Akweley Okertchiri