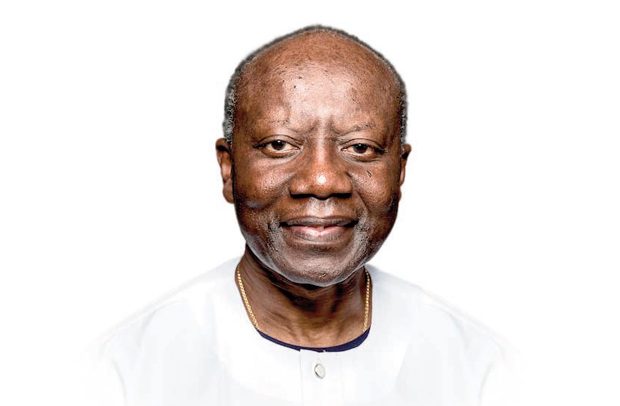

Ken Ofori Atta

GOVERNMENT HAS indicated it is hoping to secure an International Monetary Fund (IMF) Board approval of its US$3 billion bailout request by March 2023.

Finance Minister, Ken Ofori-Atta, who made this known, said “We are currently working to go to the IMF Board in March 2023 and possibly secure the Board’s approval for Ghana’s Programme.”

He was speaking to PM Express recently in Accra.

According to him, the government was additionally hoping to reach a deal with the Paris Club (International Creditors) on the country’s debt re-profiling.

There have been concerns that the country might struggle to secure an IMF Board approval, before the end of the first quarter of 2023.

This is largely due to challenges being encountered with the current negotiations regarding individual bondholders, banks and insurance companies in reaching an agreement with government.

In addition, the IMF staff is undertaking a detailed assessment of Ghana’s report before a report would be submitted to the IMF Board for approval.

The Finance Minister is, however, optimistic government would make up for the time.

Some analysts have argued that the current challenges facing the economy could be minimised if Ghana worked fast to secure approval with the IMF.

Again, securing an IMF programme could also trigger financial support from other donors, including the World Bank, European Union and other bilateral institutions.

The Governor of the Bank of Ghana, Dr. Ernest Addison, at a recent engagement with the Parliament’s Finance Committee, stated that Ghana’s International Reserves now stood at 1.5 months of import cover.

This could mean that the economy might struggle to meet its import needs if it is not able to get Balance of Payments support from the IMF by April 2023.

IMF staff and government in December last year, reached staff-level agreement on economic policies and reforms to be supported by the new three-year arrangement under the Extended Credit Facility (ECF) of about US$3 billion.

Under this programme, government aims to restore macroeconomic stability and debt sustainability while protecting the vulnerable, preserving financial stability, and laying the foundation for strong and inclusive recovery. To support the objective of restoring public debt sustainability, government launched a comprehensive debt operation which is being discussed with bondholders to help salvage the country’s current economic situation.

Furthermore to a frontloaded fiscal consolidation and measures to reduce inflation and rebuild external buffers, the Government/IMF programme envisages wide-ranging reforms to address structural weaknesses and enhance resilience to shocks.