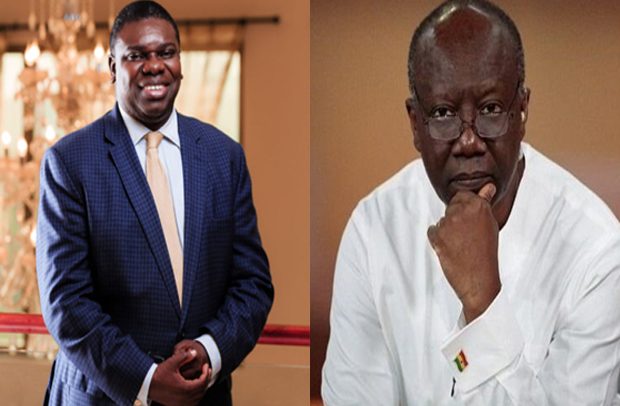

Michael Yamson, Ken Ofori-Atta

FINANCE MINISTER, Ken Ofori-Atta, has stated that the remarkable progress being made with the ongoing International Monetary Fund (IMF) is significant to the economic recovery efforts of Ghana.

Mr. Ofori-Atta said the continuous progress would steer Ghana further away from the “slippery precipice” it recently faced.

He made the remarks while addressing the nation on the Domestic Debt Exchange Programme (DDEP) vis-à-vis the IMF programme in Accra.

He noted, “Our remarkable progress with the ongoing International Monetary Fund Programme is a significant boost to our recovery efforts. Continuous progress will steer us further away from the slippery precipice we recently faced. Therefore, the momentum must be sustained.”

Considering the importance of a sustained economic recovery backed by an approved IMF programme in the first quarter of 2023, Mr. Ofori-Atta said it was crucial for groups and individuals to consider the merit of the enhanced DDEP, as well as the need for economic stability; and sign up by tomorrow to make it a successful one.

He assured Ghanaians that the DDEP would bring stability, economic recovery and transformational growth.

He added that government was resolved to continue to undertake all necessary fiscal adjustments that would ensure that the sacrifices would pay off as the collective good was upheld.

“These are difficult times, no doubt, but if we hold on together, we can and we will emerge from this more resilient and more united than before. Then we shall, together, continue rebuilding our economy again; enable businesses to thrive again; and bring back hope and cheer to our homes again,” he added.

Individual Bondholders

Meanwhile, the Individual Bondholders Forum has disclosed that none of their recommendations made to the government to raise more revenue without involving the funds of individual bondholders in the domestic debt exchange programme has been considered in the final proposals.

A member of the Forum, Michael Yamson, said all the proposals that have been presented to them have been unilateral from the Finance Minister.

“Up until now, we have essentially seen only unilateral proposals. None of the conversations that were entered into by the technical committee between the government and the individual bondholders has been reflected. All the proposals that we made that we talked about almost 83 billion cedis, none has been discussed by the government.”

The deadline for signing up for the programme expired yesterday, Tuesday, February 7, 2023.

The government has hinted that it may no longer extend the deadline for subscribing to the domestic debt exchange programme which has been postponed three times already.

Mr Ofori-Atta said though the extensions delayed the execution of the programme, such decisions were needed to alleviate the country’s “debt burden in the most transparent, efficient, and sustainable manner.”

“We admit that there were legitimate and critical concerns which needed deeper and broader consultations. The requisite efforts to address them have resulted in improved terms and changes in the closing date, with a final deadline of February 7.”

But Mr. Yamson, however, added that proceeding with the Debt Exchange Programme would eventually harm the economy and negatively affect the trust of investors in government bonds.

“There will be a long-term loss of confidence and anything that the government does in the financial space. People will simply not trust to keep their monies with the government, people will not save, and people will keep their monies in their bedrooms and that is not good for us in the long term,” he said.

The Individual Bondholders, as part of their recommendations, asked the government to divest loss-making, defunct and troubled 17 State–owned enterprises.

They also suggested that the government should review the Free SHS Programme to make it more efficient through effective targeting and allowing parents who can pay to do so.

According to the group, “beneficiaries should be students that patronise Senior High Schools in their communities whilst other students should pay for boarding. However, the government can pay for students who do not have Senior Secondary schools in their communities.”

The group stated that divesting the 17 non-performing SOEs and reviewing the free SHS alone will provide the government with GH¢2 billion.

The group also urged the government to maintain the 2022 capital expenditure level by reducing the non–ABFA MDA and foreign finance Capex provisions by 50% which they claim would provide the GH¢10.7 billion.

BY Jamila Akweley Okertchiri