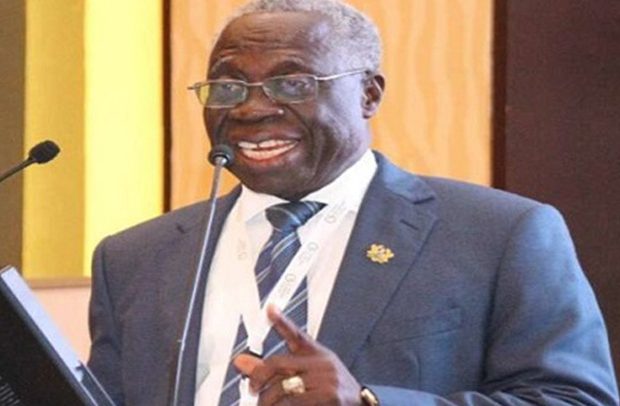

Yaw Osafo Maafo, Senior Minister

Senior Minister Yaw Osaafo Maafo has urged government to insure all its vehicles to give boost the business of insurance companies in the country to improve penetration.

Speaking to journalists on the sidelines of the opening of the 45th Africa Insurance Organisation (AIO) conference and Annual General Assembly in Accra yesterday, the senior minister said government has a lot of businesses.

“As I speak, all government vehicles are not insured. As a policy, you don’t, because the frequency is such that the government is prepared to pay for insurance cover for people in accident rather than insuring its vehicles. It’s a cost estimate. If I am to insure 50,000 vehicles and only two get involved in accident, then it’s cheaper for me to pay the accident than to do the insurance. So it’s a cost.

“The government has a lot of assets – big, assets. Who owns Akosombo? It’s the government. So if the government decides to take insurance cover for some of the major assets of government, it will increase the penetration of the insurance business.”

He said Ghana needs to create medium and long term sources of funds, and such funds could come from the insurance business.

“When the insurance business thrives, you are building up your medium and long-term funds for the development of the country.”

Insurance for buildings

He said most buildings in Accra must be insured, adding that“therefore when you talk about insurance penetration, you are talking about insurance of also certain social activities.

Funerals

“People must seek insurance for funerals. What is the penetration for let’s say funerals? Ghanaians are involved in elaborate funerals. And therefore these are areas insurance can go through. How much insurance is embedded in education? Parents should take insurance cover on behalf of their children for education so that if something were to happen to them, their education would not be interrupted.

Industry

“We are industrializing and most of our industrialized institutions are not insured. Therefore they should jump at it and convince people to take insurance policy. You cannot sit and expect people to come. You must move to them and convince them that it’s important for them to take insurance policy. And this must be done in the industrial sector, social sector, education sector to the mortgage sector.”

Prerequisite for loans

The senior minister stated that the banks should also insist on insurance cover before they grant loans to certain facilities.

“If you do that, you will improve the penetration. The idea is to spread the risk as much as possible.”

Aretha Duku, Chairperson of the local organising committee and president of the Ghana Insurers Association (GIA), commenting on the theme for the event, “Innovation, risk and the future of insurance in emerging markets” said the keys to unlocking the future of insurance in emerging markets lay not only in disruptive innovation and prudent risk management, but also in unfettered inter-African cooperation.

Alhaji Kaddunabbi Ibrahim Lubega, President of the African Insurance Organisation (AIO), in a speech, said: “For far too long we have decried Africa’s low insurance coverage, which is barely entering two percent of global insurance.

According to the 2018 Africa Insurance barometer, a survey published by the African Insurance Organisation, the continent’s low insurance penetration still presents one of the market’s largest opportunities.”

AIO accounts for 360 members, with 16 of them from nine countries overseas.

By Samuel Boadi