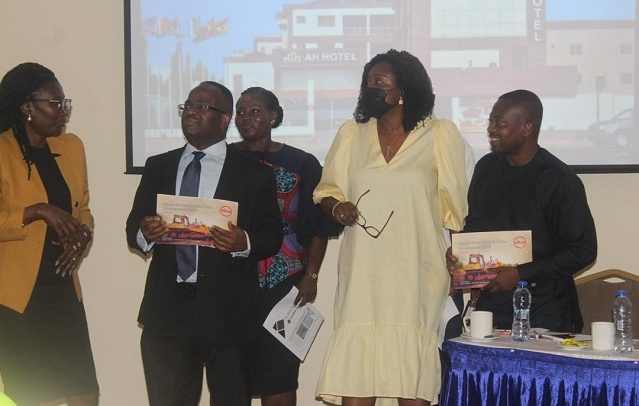

Koney (Second from left) with Akwaboah (first right) and banks’ representatives

THE GHANA Chamber of Mines, in partnership with three financial institutions, has launched a programme to financially support members to enhance their services and productivity.

The launch of the ‘Chamber of Mines’ Supply Chain Financing Programme,’ in Accra yesterday, makes way for members to access financial products tailor-made for mining support services companies in the Ghanaian mining industry.

Chief Executive Officer of the Ghana Chamber of Mines, Sulemanu Koney, said the programme was developed in response to the financial challenges its members especially, the mining support services companies, faced.

“Having identified that problem, we put together a team to find a way of designing products which are tailor-made to serve the needs of the mining companies as well as the mining support services companies that is what we have launched today” he added.

Mr Koney indicated that the idea is to make sure that members of the chamber have the best capacity in terms of technology and financing.

“We are not looking for financial products which are picked from the shelves, we want cutting edge and customised products for them so they can get the best capacity to also produce for the mining companies within the country and once they get to a certain level they can even export beyond the shores of this country,” he added.

Giving an overview of the programme, Chairman of the tender committee, Clifford Adu-Biney, said the committee started work in the fourth quarter of 2020 following which banks expressed interest and three banks, Absa Bank, Cal Bank and Republic Bank were shortlisted as the partnering financial institutions.

He said the programme aims to offer between short to long term uniquely designed solutions in areas such as purchase order financing, trade receivables financing, leasing of fixed assets, cash flow lending solutions, suppliers credit facilitation and guarantees among others.

He noted that the launch would be followed by the set up of a technical committee of experts to receive and review project financing proposals from businesses and affiliates desirous of exploiting production and manufacturing opportunities.

“We will also provide technical advice and guidance to translate such proposals into feasible and bankable projects for consideration by partners Banks and other financial and capital markets participants,” he added.

.By Jamila Akweley Okertchiri