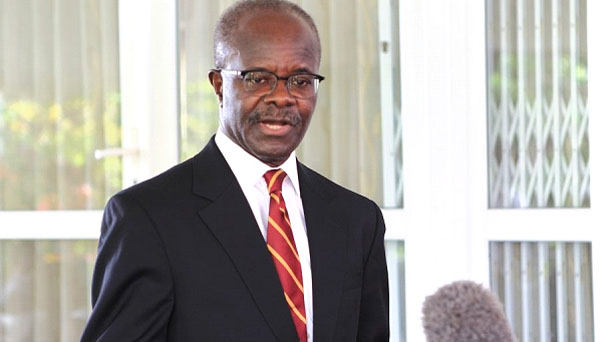

Dr. Papa Kwesi Nduom

Groupe Nduom, a multinational Ghanaian company belonging to politician and businessman Dr. Papa Kwesi Nduom, has denied engaging in money laundering or committing wire and mail fraud, after US-based Birim Group LLC filed a lawsuit accusing the conglomerate of laundering $63,000,000 of depositors’ funds through its Virginia-based Procurement and Consulting Service Company.

The plaintiff company said Dr. Papa Kwesi Nduom and his family members, by and through their ownership and control, used GN Bank, Gold Coast Fund Management and over 60 under capitalised interrelated companies to “engage in a racketeering conduct predicated on illegal monetary transactions.”

According to the Birim Group, the defendants namely Dr. Paa Kwesi Nduom, his wife Yvonne Nduom and his children Nana Kweku Nduom, Edjah Nduom and Nana Aba Nduom allegedly used the said laundered money to “fund eponymous vanity projects such as a sports stadium, a university, a foundation and a soccer club,” intimating that they were “motivated by nothing more than greed and self-aggrandisement.”

“Defendants’ actions not only cost depositors their life savings and untold hardship; they have contributed significantly to a serious ongoing financial crisis in the Republic of Ghana,” the plaintiff company said in a writ filed in US District Court in Northern District of Illinois.

Fighting Back

But Dr. Nduom, founder and former flag bearer of the Progressive People’s Party (PPP), denied the accusations through his representatives, describing the action by the plaintiff as an attempt to use the court to smear him as a Ghanaian entrepreneur and political leader.

“Birim Group itself is a murky LLC whose members the complaint does not identify. It does not claim to have had any dealings with Dr. Nduom or the other defendants,” the lawyers stated in a motion to dismiss the case.

“Rather, Birim Group claims to have paid for the claims of two Ghanaian citizens, Mavis Amanpene Sekyere and Nana Kwame Twum Barimah (the “Assignors”), who have what at most, amounts to breach-of-contract claims under Ghanaian law against Ghanaian bank, GN Bank and Ghanaian investment firm, Gold Coast Fund Management (GCFM) and collectively, the Ghanaian Defendants,” the defendants argued.

The statement indicated that the plaintiff company did not buy these “claims to recover Ghanaian deposits,” but rather under the pretext to “malign Dr. Nduom, his family and anyone who does business with him.”

Factual Allegations

“In lieu of factual allegations as to each defendant, the complainant alleges that all corporate forms should be disregarded and each defendant should be deemed an alter ego, not just of each other defendant, but also of each employee of each corporate defendant, including the Ghanaian defendants.

“No facts are alleged to support this extraordinary conclusion,” the statement pointed out, and added that “complainant ultimately fails against the US defendant because no US defendant is alleged to have done anything to cause either the assignors harm – and the focus must be on the assignors.”

The defendants insisted that Birim Group had no business with them and that the company’s claim it paid assignors’ claims hence the suit amounted to “a political smear” and not to engage in a legitimate exercise to use the court to resolve a legal dispute.”

“The complaint in this case is an object lesson in why Rule 9(b) exists and applies to RICO and fraud-based claims. Birim Group bought and paid for the right to bring this complaint, including on behalf of an Assignor who is pursuing the same substantive claim where it belongs – in a Ghanaian court against a Ghanaian defendant.

“The Assignors’ losses are $52,219 and $30,000, respectively. So why did Birim Group buy the claims and file such an overblown complaint, invoking RICO, multiple frauds and tort theories? The answer was stated at the outset: because this case is a political smear and not a legitimate use of the court to resolve a legal dispute,” the lawyers argued further.

Birim Fire

However, the Birim Group LLC insists Dr. Nduom and his family have questions to answer, alleging that they believe US to be a safe haven for the proceeds of “their fraud,” saying that the alleged criminal scheme involved among other things the transfer (through the instrumentality of the international money wire system) of inflated, over-invoiced and above-market rate fees disguised as payment for “management services” to defendant IBS.

“In fact, IBS is nothing but a shell company with an industrial zone store front office, no staff and a bare bones four (4)-page website created solely to facilitate the Nduom defendants’ fraud,” the plaintiff company posited.

By Ernest Kofi Adu