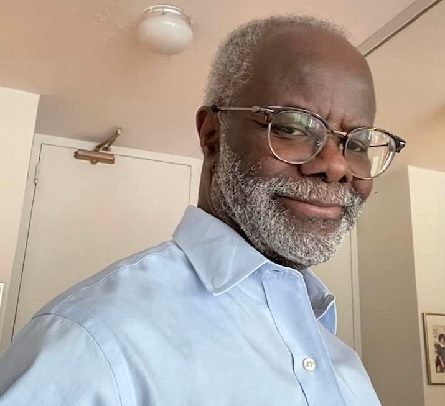

Dr. Papa Kwesi Nduom

PRESSURE IS mounting against Dr. Papa Kwesi Nduom’s US-based financial institution, GN Bank, following complaints by some of the customers against him.

Customers are complaining about problems they are having with the small bank situated on a tree-lined street on Chicago’s South Side.

Some even fear losing their homes because of the last Black-owned bank in the state’s poor and ache record-keeping system, per an investigative report by CBSNEWS in partnership with ProPublica in the US.

Also, the bank, described as ‘Flinstones’, is under a federal consent order that noted several deficiencies that needed fixing fast.

GN Bank took over the operations of Illinois Service Federal Savings and Loan (ISF) after financial transaction between the two management. ISF opened in 1934, offering mortgages, homeownership assistance, and access to banking for Chicago’s underserved Black neighbourhoods. However, somewhere in 2008, ISF was hit with recession together with other banks when it began to struggle.

By April 16, 2015, ISF was under a federal consent order issued by the Office of the Comptroller of the Currency (OCC), one of the agencies tasked with regulating banks and financial institutions.

The order required that the bank should come up with a plan to get out of financial trouble and hire competent management.

A year later, ISF thought it had found its saviour in Dr. Papa Kwesi Nduom, who purchased the bank.

Dr. Nduom reportedly agreed to take control of ISF and pump US$9 million into it, but was said to have failed to do so, raising more complaints from customers.

Aggrieved customers of GN Bank talking to reporters

For instance, Sharon Stewart, one of the customers of the bank, said for over 30 years,

her late mother, Dorothy, held a mortgage at ISF because she wanted to support the bank’s commitment to community.

“It was a sense of pride,” she said, “They invested in the community and helped African Americans get mortgages.”

Stewart says her mother also enjoyed the intimate, friendly customer service at ISF, because “She could go in there and talk to them personally,” Stewart said. “She loved it. Absolutely.”

Eventually, Stewart added her name to the mortgage and carried on that commitment to support what eventually became GN Bank — and ultimately became the last Black bank in Chicago.

She has a different feeling about the bank today.

“I am very disappointed. I’m so disappointed with them,” Stewart said. “They take your money. They do nothing for you.”

Aggrieved customers of GN Bank talking to reporters

Stewart told CBS 2 that since GN took over, customer service has gone downhill.

“There’s no one to speak to,” she said.

She also said normal banking procedures are not followed.

“I don’t even get bank statements,” Stewart said.

Worst of all, she said, is the time she thought she might lose her mother’s home.

“The last bank statement that we received was December 2017. And that’s when Yorke Properties came about,” Stewart said.

And she said that was when all the trouble with that loan began. Stewart met with the then vice president of the loan department.

“He told me that the property had been in foreclosure since June of 2018,” she said.

Stewart said her mother had automatic loan payments set up with ISF/GN Bank.

But Stewart found out that GN Bank had sold the mortgage to Yorke Properties, LLC.

Dr. Nduom is Chairman of GN Bank. He’s also listed on state LLC records as a manager of Yorke Properties.

Stewart received a collection notice in 2021. The notice informed her that she was in default on her mother’s Yorke Properties mortgage loan.

She had to prove the loan was current to avoid foreclosure, as Stewart had to be going to GN Bank every month to make the loan payments after that.

She described her monthly routine, “I presented the check with the loan numbers on because there are no payment coupons — nothing. So I always write [on] a piece of paper the address, my mother’s name, my name, the check number, how much I’m paying, the loan numbers that they told me are the loan numbers — and I always write a statement that GN Bank does not provide annual or monthly statements, nor payment coupons.”

After the payment is made, Stewart explained: “They’ll give me a handwritten receipt. From a financial institution — that’s my receipt. It’s like the Flintstones. That’s what I call it.”

For fear of foreclosure, Stewart said she kept all of those handwritten receipts and cancelled checks totaling US$60,000 to prove to GN Bank that the loan was not in default.

She blames this whole mortgage mix-up, missing statements, and antiquated receipts on the chairman of the bank, Dr. Nduom.

“They do not run it like a financial institution in the United States at all,” Stewart said.

Interestingly, Stewart is not the only customer complaining.

Robert Jansen had to drive 110 miles each way from his home in Marseilles to GN Bank in Bronzeville every month to also make his mortgage payments. He’s a real estate investor – so he has a lot of them.

“Through ISF at one time, I had 18 mortgages,” said Jansen. “I’m down to 10 now.”

Jansen pays in person at the bank because he’s heard of stories like Stewart’s and is afraid something similar could happen to him.

“I’m afraid he’s going to sell these mortgages to Yorke Properties — not notify me,” Jansen said. “I don’t want to be sold to Yorke, because Yorke don’t send statements either. They just come in and foreclose.”

Jansen keeps every receipt he gets from the teller to prove “my mortgages are paid.” And like Stewart, he questions the type of receipts given out by GN Bank, comparing them to something that might come from a fast food place.

“Ever since they changed the system over to a new system that gives you these Burger King coupons, that’s your payment history,” Jansen said.

Stewart reported her issues with GN Bank to the OCC as a public records request from ProPublica was said to have revealed many other customers filed complaints between 2016 and 2021.

“We got back more than 20 cases where dissatisfied customers complained to various federal bank regulatory agencies about problems with GN Bank that included, among other things, the bank’s handling of mortgages, handling of other accounts, and poor customer service,” OCC alleged.

In some cases, the OCC responded by saying it “does not have the judicial power to interpret or enforce private contractual agreements.” In other cases, the OCC advised customers to take their concerns to other state or federal agencies or take GN Bank to court.

GN Bank, while not being particularly responsive to its own customers, most of the time did respond when the OCC followed up on customer complaints and asked the bank to reply.

The OCC has another interest in GN Bank. This concerns the latest consent order it issued on September 17, 2020.

Jeremy Kress, an Assistant Professor of Business Law at the University of Michigan and also the Co-Faculty Director of the school’s Center on Finance, Law & Policy and a former regulator with the Federal Reserve told CBSNews that based on the 2015 consent order and the new one, it suggests that GN Bank is pretty far down the path of having very significant problems that its primary supervisor has been encouraging the bank to fix for quite some time.

The 2020 consent order cites some old concerns “about the quality of the loans on its books,” said Kress.

The 2020 consent order specifically calls out GN Bank leadership since they took over ISF and it stated that, “The Board and management have not corrected previously identified unsafe or unsound practices.”

By Vincent Kubi