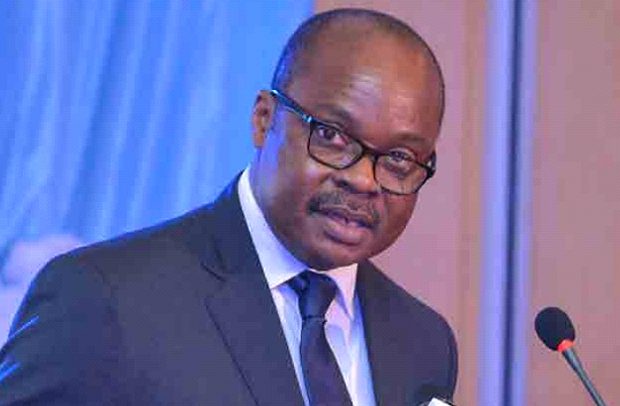

Dr. Ernest Addison, Governor of the BoG

The Bank of Ghana (BoG) has disclosed that the Non-Performing Loans (NPL) of commercial banks in the country remain high despite the clean-up carried out in the sector.

Governor of the BoG, Dr. Ernest Addison, made this known to journalists on Monday, May 27, 2019, in Accra.

He presented highlights of the 88th meeting of the Monetary Policy Committee (MPC) of the Central Bank.

The governor said that “although the Non-Performing Loans (NPL) ratio has declined from 23.5 per cent in April 2018 to 18.9 per cent in April 2019, it remains high and points to the industry’s exposure to credit risk.”

According to him, to help further reduce the NPL ratio, banks are working to strengthen their credit risk management practices and loan recovery efforts.

Giving an outlook of the banking sector following the massive clean-up exercise between 2017 and 2018, which led to the collapse of some seven indigenous banks, the Governor observed that over the first four months of 2019, banks’ total assets amounted to GH¢109.9 billion.

That, he said, represented an annual growth of 12.4 per cent, adding that the growth in total assets was funded mainly from deposits, which grew by 19.6 per cent year-on-year to GH¢73.1 billion.

According to him, the industry’s financial soundness indicators have improved, with the Capital Adequacy Ratio (CAR) at 21.4 per cent in April 2019 significantly higher than the prudential requirement of 10.0 per cent.

Under the new BoG Capital Requirement Directive (CRD), the CAR was 17.4 per cent compared to the 13.0 per cent prudential requirement.

The Governor revealed that private sector credit growth continued to gain traction, as the banking sector’s liquidity improved through the recapitalization exercise.

According to him, “Annual growth in private sector credit was up by 19.8 per cent in April 2019 compared to 5.6 per cent growth in the same period of 2018.”

He added that “on a year-to-date basis, private sector credit recorded a 5.1 per cent growth in April 2019 compared to a contraction of 4.0 per cent last year.”

Dr Addison, however, disclosed that asset quality remains a key challenge and major constraint to credit expansion in the banking sector.

By Melvin Tarlue