PIAC Chairman, Professor Kwame Adom-Frimpong

The Public Interest and Accountability Committee (PIAC) has asked management of the Jubilee Oil Holding Limited (JOHL) to pay the oil proceeds of its first lifting into the Petroleum Hedge Fund (PHF).

According to PIAC, following the acquisition of seven percent interest of the Jubilee and TEN Fields by JOHL, it has made its first lifting (944,164bbls) on the Jubilee Field in the first half of this year, amounting to US$100,748,907.95.However, the amount was not paid into the PHF.

“PIAC recommends that the proceeds of liftings by JOHL should be paid into the Petroleum Holding Fund (PHF), as the committee is convinced that the proceeds form part of Ghana’s petroleum revenues,” it said.

The committee also noted that contrary to Section 6(e) of the Petroleum Revenue Management Act, 2011 (Act 815), Capital Gains Tax was not assessed and collected by the Ghana Revenue Authority (GRA) in the sale of the seven per cent interest by Anadarko in the Jubilee and TEN Fields in 2021.

“In its written response to PIAC on the matter, the Ghana Revenue Authority referred the committee to the Ministry of Finance indicating that the ministry was exclusively in charge of the transaction. The Ministry of Finance, in turn, referred the committee to the Ghana Revenue Authority for answers,” the committee said.

Meanwhile, PIAC said the surface rentals outstanding continue to increase indicating that as at the end of first half of 2022, the balance outstanding was US$2,774,702.29 constituting an increase of 7.58 percent on the surface rentals of US$2,579,170.21 at the end of 2021.

“The Ghana Revenue Authority (GRA) needs to intensify its efforts at collecting surface rental arrears in addition to any new assessment before the end of the year. To enable GRA assess and collect revenues from IOCs before they exit Ghana, the Minister for Energy is encouraged to inform GRA and other relevant institutions before the termination of PAS,” it added.

This was contained in the 2022 PIAC Semi-Annual Report which covers the period January to June 2022.

The report encompasses a broad range of issues relating to petroleum revenue management including the funds set aside in the Ghana Petroleum Funds; Ghana Stabilisation Fund (GSF) and the Ghana Heritage Fund (GHF).

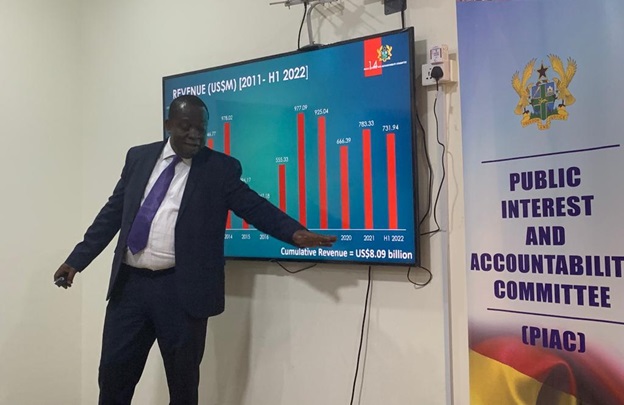

PIAC Chairman, Professor Kwame Adom-Frimpong, presenting the report highlights, said the Ghana Petroleum Funds (GPF) received an amount of US$390,029,916.55 for the first half of 2022.

The amount, he said, represents a 91.43percent higher than the budgeted allocation of US$203.75 million for the GPFs for the full year in compliance with Section 4(a)(iii) of the Petroleum Revenue Management (Amendment) Act, 2015 (Act 893).

Prof. Adom-Frimpong said the report found that an amount of US$25.62 million was transferred to the Ghana Infrastructure Investment Fund(GIIF) in the first half of 2022.

“According to the fund, the entire disbursement was used to support the Agenda 111 Project of the Government.This is the second time, since 2011, that GIIF has received funds for Government’s Agenda 111 Project. In 2021, an amount of $49.39 (GHC290,377,059.18) was allocated to the fund. PIAC is yet to receive specific details of all disbursements,” he said.

He also indicated that GH₵201,996,032.27 of the Annual Budget Funding Amount (ABFA) was unutilised by the end of 2021, representing 9.80% of 2021 utilisation.

Also, he said no transfer of ABFA was made into the District Assembly Common Fund (DACF) during the first half of 2022, even though an amount of GH₵157.77 million had been budgeted for 2022.

“PIAC recommends that Government should direct subsequent disbursements to GIIF intended for Agenda 111, to the Ministry of Health to support the Agenda 111 Project.

Additionally, GIIF should focus the utilisation of its share of ABFA on its core mandate of investing funds in commercial infrastructural projects, in accordance with the GIIF Act, 2014 (Act 877) and policy guidelines of the Fund,” he said.

By Jamila Akweley Okertchiri