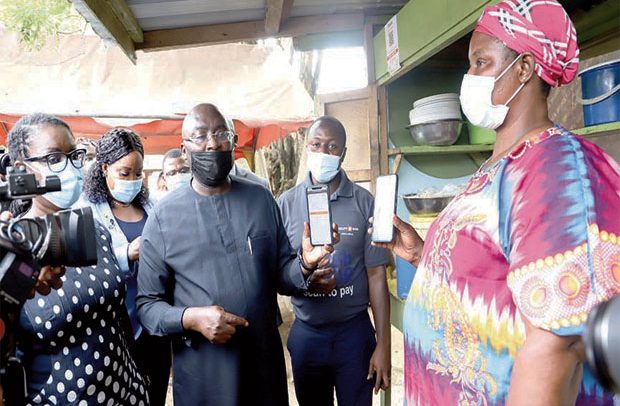

Vice-President Dr. Bawumia and Aunty Muni Waakye displaying their phones on the GhIPSS QR Code. Looking on is Ursula Owusu Ekuful (left). Picture by Gifty Ama Lawson.

Ghana reached a significant milestone in its digitisation agenda when it started the use of the Quick Response (QR) Code system yesterday.

QR code is a barcode machine-readable optical label that contains information about the item to which it is attached. In practice, QR codes often contain data for a locator, identifier or tracker that points to a website or application made up of black and white squares which represent certain pieces of information that can instantly be read using a smartphone camera, and basically works in the same way as a barcode during a transaction.

At a launch in Accra yesterday, Vice-President Dr. Bawumia could not hide his excitement as he and Communications Minister, Ursula Owusu Ekuful, used the application to buy the local waakye from popular Auntie Muni Waakye joint at a location in Ridge.

An obviously elated Dr. Bawumia could not hide his excitement when the transaction went through instantaneously and in real time.

“It is a very historic day because we are solving a major problem here in Ghana…Ghana will be the first country in Africa to launch a QR Code payment system. Not only are we the first country in Africa, we are also, as far as I am aware, the third country in the world to do a universal QR Code after Singapore and India.”

Even in the case of Singapore and India, he indicated that their QR Codes only catered for bank customers, while Ghana’s would cater for both bank and non-bank customers including mobile money customers.

“The QR Code essentially allows all people who receive payments to receive the payments on their mobile phones; so if you go, you can pay using your mobile phone. The merchant can receive the payment using their mobile phone instantly,” he explained, and added that “you scan the QR Code and you can confirm that yes this is the merchant and I am paying this amount to. It is very secure in that regard and very convenient.”

That, he said, went to solve a problem that had been with the Ghanaian economy since independence; adding that the country is more of a cash-based economy which makes it inefficient for the simple reason that most people are excluded from the financial system, aside the risk of robberies and contracting viruses through physical cash transactions.

He therefore described Ghana’s Code as unique and the first of its kind in the world, saying “and so we have to be rightly proud as Ghanaians that we are using technology to solve a problem that exists in our society and in doing so we are really leading the world in this manner;” while commending the collaborative effort between Ministry of Communications, the Bank of Ghana, Ghana Interbank Payment and Settlement System (GhIPSS), the telecommunications (mobile phone service providers) companies (telcos) and the financial service providers (Fintechs).

So far 13 banks have started operating on the QR Code system, with the Vice-President and Ms. Ekuful urging Ghanaians to hook on to the system and join the fray.

The Ghana QR Code (GhQR) is a new and easy way to make payments to a merchant by scanning a QR Code displayed by the merchant with one’s mobile phone.

The merchant gets the money instantly, just like paying with cash.

There are two ways by which one can make payments with GhQR at a merchant location, by scanning to pay or dialling to pay using a smart-phone (Scan to Pay): Log into ones mobile app and follow the prompt instructions) to pay.

Using a feature phone (Dial to Pay) or what has come to be known as ‘yam phone’, one needs to Dial the USSD code (e.g.*123#) of his or her payment service provider and follow the prompt to pay any merchant irrespective of where they received their GhQR point of sale display from.

Once payment is successful, both the customer and the merchant will receive transaction notifications.

By Charles Takyi-Boadu, Presidential Correspondent