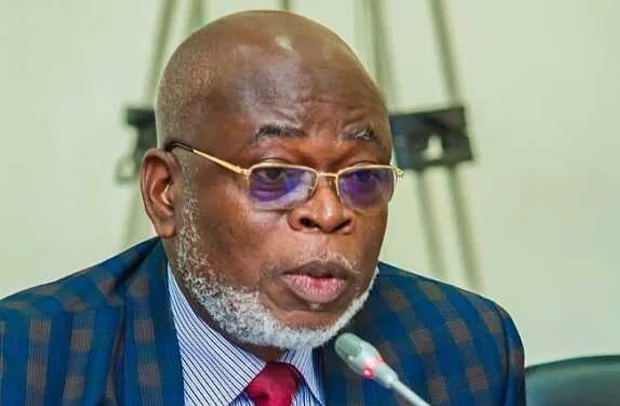

Dr. James Klutse Avedzi, SEC Boss

The Securities and Exchange Commission (SEC) has issued a notice to the public after identifying 33 television stations airing suspected fraudulent “money-doubling” investment schemes across the country.

These stations include Advice TV for ECO Cash, Adwempa TV for RBC Royal Bank, Akyedie TV for Nana Bodom, Asomafo TV for ECO Cash, Asomdwie TV for ECO Cash, Benedict TV for ECO Cash, Best TV for Airopay, Big TV for Airopay/Chase Bank, Breeze TV for Instant Money, and Diamond TV for Airopay/ Chase Bank.

Others are Eagle TV for WorldRemit, Today’s GH TV for Unnamed Product, Simple TV for Airopay/Chase Bank, Star Boy TV for ECO Cash, Elephant TV for Nana Bodom, TV Magic for WorldRemit, Energy TV for Airopay Wave Money, Unik TV for ECO Cash, Funny TV for ECO Cash, Golden TV for Nogokpo, Goodness TV for ECO Cash, Hyebre TV for Airopay/Chase Bank, VIP TV for WorldRemit, XTV for Arab Money/Eco Cash, Happy TV for Airopay/Chase, and KTV TV for ECO Cash.

The rest are Kumaplus TV for US Bank Online Loan, Megyefo TV for Nana Bodom (WorldRemit), MY TV for ECO Cash, Nkabom TV for Airopay/Chase Bank, Passion TV for IMONEY/Airopay, Run TV for Wave Money Transfer, and Seekers TV for US Bank online loan.

In a statement issued yesterday, the Commission disclosed that these schemes promise unusually high returns at little or no risk, a typical tactic used to deceive unsuspecting Ghanaians.

It stressed that none of the operations being advertised have been approved or licensed to carry out investment activities in the country, and urged viewers to be vigilant as well as avoid falling victim to such scams.

“The SEC hereby informs the public that it has not approved, authorised or licensed any of the schemes being advertised on these television channels,” the regulator said.

According to the Commission, operators of these schemes are in breach of Section 144(1) of the Securities Industry Act and Section 294(1)(b) of the Companies Act, which prohibit unlicensed public advertisements for securities related products. Those involved in such activities could face criminal prosecution, the Commission warned.

The caution comes amid growing concerns on the rise of financial fraud, following past investment scandals that affected thousands of people.

The SEC stated that it is monitoring the situation to safeguard investor funds and maintain confidence in the capital market.

The public has been encouraged to verify the licensing status of any investment-related firm before committing funds.

The Commission reaffirmed its commitment to protect investors as well as ensure a transparent and trustworthy securities market.

The public is advised to call for assistance on the SEC’s toll-free line 0800 100 065, its main line 0302 768 970–2, or email info@sec.gov.gh.

By Florence Asamoah Adom