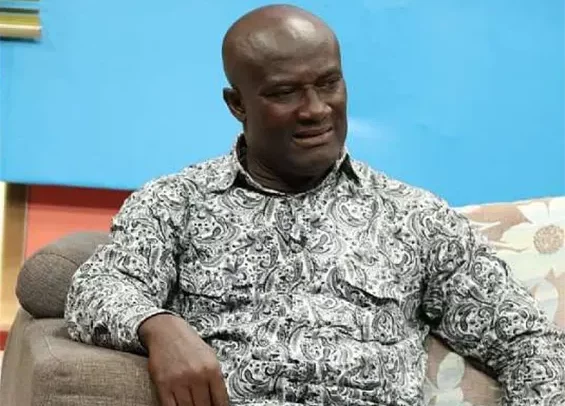

Clement Boateng – GUTA President

The Ghana Union of Traders’ Association (GUTA) has issued a final notice to the government and the Ghana Revenue Authority (GRA), to immediately suspend and review the VAT Act 1151.

Speaking at a press conference, GUTA President, Clement Boateng, stated that the current implementation of the Act is hindering the trading community and can lead to widespread industrial action if their grievances are not addressed.

GUTA argued that most of the traders under their union fall below the input threshold which makes the VAT reform higher for its members.

“We are calling on the government to review the VAT Act 1151 urgently,” he said.

GUTA further stated that the complex nature of the current VAT structure makes it unattractive and difficult to comply with.

He emphasised making the VAT structure simple for the informal sector will make it easy for the members to comply since the informal sector makes up a huge part the country’s economy.

“The status quo must be restored to a 3% to 4% flat rate for the informal sector, this is the only way to make compliance easy and realistic for the average trader, he added.

He argued that the current standard rate system is rigorous for small-scale importers and retailers which leads to unintended tax evasion and friction between traders and GRA officials.

He mentioned that GRA should look out for traders who are not paying taxes rather than overburdening those who are paying.

“Instead of over-taxing the few who are already compliant, let us find the thousands who are outside the system, he said.

He stressed that the GRA should focus on intensifing traders education and registration stating that the authority should move out of their offices to the shop floors to find out the true situation on the ground.

”GRA should intensify trader registration and education to broaden the tax net and increase revenue,”he added.

The Union also suggested that the government should make VAT registration an attractive prospect rather than a purely punitive one.

“Introduce incentives for shops and retail outlets to mandatorily register and pay VAT. When you broaden the tax base through incentives, the burden on the individual trader lessens, and national revenue naturally climbs,” he added.

By Florence Asamoah Adom