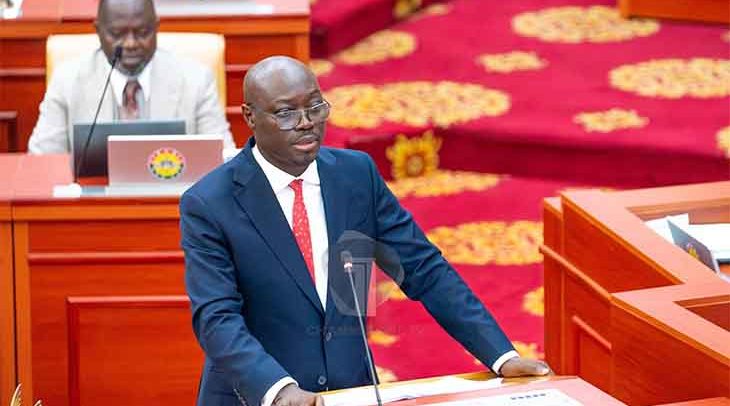

Dr. Cassiel Ato Forson

The Minister of Finance, Dr. Cassiel Ato Forson, has announced plans by the government to introduce a new Value Added Tax (VAT) reform bill that will eliminate the COVID-19 Health Recovery Levy and simplify the country’s VAT regime.

According to him, the bill, which is expected to be presented to Parliament in October 2025, forms part of wide-ranging fiscal measures to ease the burden on businesses and improve tax efficiency.

Presenting the 2025 Mid-Year Budget Review to Parliament, Dr. Forson said the reform is aimed at addressing persistent distortions in the VAT structure and eliminating cascading effects that drive up the cost of goods and services.

He added that the VAT flat rate scheme would also be abolished under the new law, in favour of a more unified and equitable tax framework.

The minister explained that the COVID-19 levy, introduced as a temporary measure, had outlived its purpose and its removal would directly reduce the cost of doing business and improve consumer confidence.

According to him, the reforms will also raise the VAT registration threshold to exempt small businesses, particularly those in the informal sector, from the tax net.

Dr. Forson noted that the upcoming reforms have been developed in consultation with the International Monetary Fund (IMF) and are undergoing extensive stakeholder engagement across the country. He said government aims to complete consultations by September, after which the bill will be laid before Parliament as part of the 2026 Budget.

He stressed that the reforms are not designed to increase the tax burden but to make the system fairer, more transparent, and growth-friendly. He also reaffirmed the government’s commitment to deploying digital tools, such as electronic fiscal devices, to boost compliance and reduce revenue leakages.

He pointed out that this is part of broader fiscal consolidation efforts under President John Mahama’s administration, which has already seen a historic reduction in public debt, appreciation of the Ghana cedi, and declining inflation. Dr. Forson described the VAT reform as a critical next step in improving the business climate and restoring investor confidence.

“These reforms will make our tax system simpler and more efficient, ensuring that businesses can thrive and the economy remains resilient. We are committed to building a fairer and more modern tax structure that reflects the realities of our economy and meets the aspirations of our people,” he said.

By Ernest Kofi Adu, Parliament House