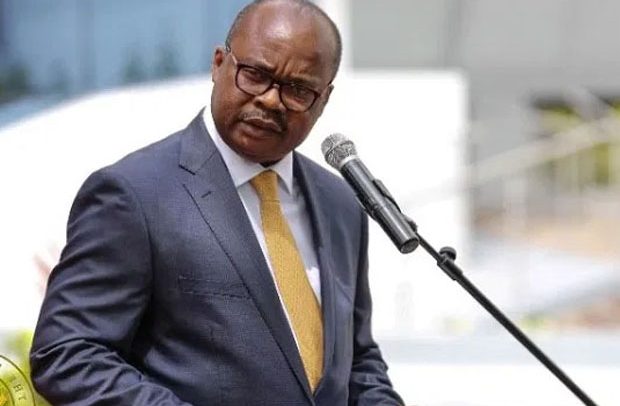

Governor of the Bank of Ghana (BoG), Dr Ernest Addison has expressed concern about the financing shortfall for women-owned businesses in the country.

This Dr. Addison said it is because women entrepreneurs encounter various obstacles when accessing finance

He explained that in Sub-Saharan Africa, the gender gap in access to finance, according to the World Bank Findex report of 2021, is at 12 percent, higher than the average of 6 percent for the developing world.

In Ghana, he said the gap as of 2021 had widened to 11 percent, compared with 9 percent that had persisted since 2017, although the percentage of women accessing finance had increased from 27 percent in 2011 to 63 percent in 2021.

Despite the critical role of women in economic development, access to finance has been a major constraint for women-owned businesses, Dr Addison stated.

With an estimated US$42 billion financing shortfall for African women-owned businesses as estimated by the African Development Bank (AfDB) across all value chains, women entrepreneurs encounter various obstacles when accessing finance.

This, he said translates into constrained overall economic growth and resilience, and lost opportunities for all.

“Indeed, it is well-established by existing literature that improving women access to finance positively impacts consumption levels, increases economic growth and socioeconomic development, promotes financial stability, and improves overall resilience of economies.

“Broadly speaking, promoting gender-inclusive finance serves as a catalyst for rapid, sustainable, and resilient economic growth and socio-economic development.

“The market for finance for women-empowered businesses in Africa therefore remains untapped, and holds significant promise for financial institutions and Governments need to tap into. Ghana’s efforts in this regard have been noteworthy, although much remains to be done.

“The Government of Ghana’s National Financial Inclusion and Development Strategy (2017-2022) set out to increase access to finance for women as part of a comprehensive strategy to increase financial inclusion to underpin inclusive macroeconomic growth and development.

“Other Government interventions such as credit lines to SMEs through the Ghana Enterprises Agency, the Ghana Women Fund, and others continue to provide a lifeline to women-empowered businesses,” Dr Addison said at the launch of the Affirmative Finance Action for Women in Africa (AFAWA) Finance Series in Accra on Tuesday, February 28.

He further stated that on the part of the Bank of Ghana, in addition to providing the enabling regulatory environment to promote financial stability, we are fully committed to promoting inclusive finance and gender-inclusive finance particularly.

As a member of the Alliance for Financial Inclusion, the Bank of Ghana has made commitments under the Denarau Action Plan on Gender-Inclusive Finance, to advance gender-inclusive finance with emphasis on promoting women’s access, usage and quality of financial services and products.

In November 2019, the Bank of Ghana launched Ghana’s Sustainable Banking Principles – a set of seven ESG–related principles, which enjoins banks to among other things promote financial inclusion and gender equity in their internal operations and in relation to their delivery of products and services to clients.

Banks are currently reporting to the Bank of Ghana on a quarterly basis, in compliance with these principles, and we expect to see higher levels of compliance.

“We believe that the AFAWA initiative will be critical in supporting the banks with the necessary capacity building and sources of funding to support their efforts at improving more gender-inclusive finance,” Dr Addison said.

By Vincent Kubi