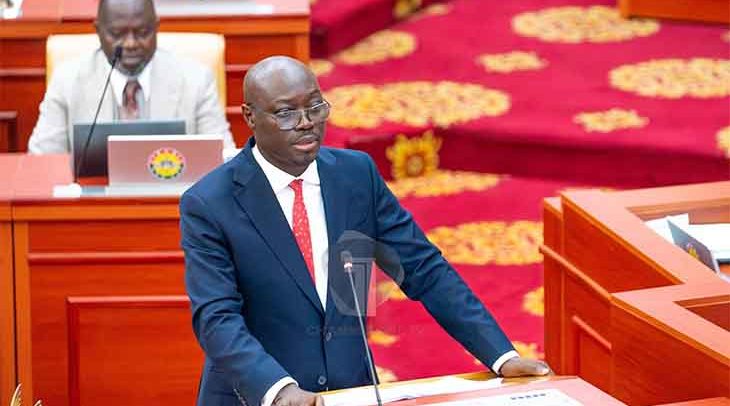

Dr. Cassiel Ato Forson

Parliament has repealed multiple controversial tax policies, including the Electronic Transfer Levy (E-Levy), the emissions tax, and withholding taxes on betting, lottery, and unprocessed gold.

The decision, aimed at easing financial burdens on citizens and businesses, follows the passage of key amendment bills on taxation.

The move comes after the Finance Committee of Parliament reviewed and recommended the repeal of these taxes, following deliberations with the Minister for Finance, Dr. Cassiel Ato Baah Forson, and other key stakeholders.

E-Levy Scrapped

The much-debated Electronic Transfer Levy (E-Levy), which imposed a 1% tax on mobile money and electronic transactions, has been repealed. The repeal bill, introduced by the Minister for Finance, Dr. Cassiel Ato Baah Forson, was presented to Parliament on March 13, 2025, in line with Article 174 of the 1992 Constitution. Following its first reading, the bill was referred to the Finance Committee, which thoroughly reviewed its implications before recommending its passage.

The government argued that the levy discouraged electronic payments and placed an undue financial burden on citizens. The repeal is expected to encourage digital transactions and improve the disposable income of individuals.

Reasons for Repeal

The Electronic Transfer Levy was originally implemented in 2022 as a 1% tax on electronic transactions, including mobile money payments, bank transfers, merchant payments, and inward remittances.

The levy was intended to widen the tax base and boost domestic revenue. However, it faced strong public opposition, with many citizens arguing that it reduced disposable income and discouraged digital transactions.

According to the Finance Minister, the repeal aligns with ongoing tax reforms aimed at reducing the financial burden on Ghanaians, and the removal of the levy is expected to increase disposable income for households and encourage greater use of digital financial services.

Revenue Implications

The repeal of the E-Levy is projected to result in a revenue loss of approximately GH¢1.96 billion for the 2025 fiscal year. However, Finance Minister Dr. Forson assured Parliament that alternative revenue measures had been put in place to offset this loss, ensuring that key government programmes remain unaffected.

Betting and Lotto Taxes Removed

In related development, Parliament has also repealed the 10% withholding tax on winnings from lottery, betting, and other gaming activities. According to the Finance Committee’s report, the tax negatively affected earnings, especially for those who relied on gaming as an income source. The repeal is expected to boost patronage of gaming activities and increase disposable income for individuals.

Emission Tax Repealed

The Emissions Levy Act, 2023 (Act 1112), which sought to impose taxes on carbon dioxide emissions from vehicles, has also been scrapped. The tax was never implemented due to public opposition, and the government stated that it would re-engage stakeholders on a better approach to environmental taxation.

Gold Tax Removal to Combat Smuggling

Parliament also voted to remove the withholding tax on unprocessed gold purchases. The government observed that the tax had led to increased smuggling, with Ghana reportedly losing up to $10 billion annually in illicit gold exports. With the repeal, the government hopes to encourage small-scale miners to sell their gold to accredited state institutions rather than smuggling it abroad.

Alternative Revenue Measures

While concerns were raised about revenue losses, the Finance Minister assured Parliament that alternative tax policies were in place to compensate for the repealed levies. He emphasised that the government remains committed to growing the economy, creating jobs, and ensuring fiscal stability.

VAT Exemption on Motor Vehicle Insurance

The House again amended the Value Added Tax (VAT) Act, 2013 (Act 870) to remove VAT on motor vehicle insurance.

According to the Finance Minister, VAT on motor vehicle insurance was introduced in 2023 when the government amended the VAT Act to exclude non-life insurance from VAT exemptions.

As a result, he said insurance premiums, including motor vehicle insurance, became subject to VAT, leading to increased costs for both individual vehicle owners and transport operators.

The Minister noted that the tax burden was particularly challenging for private individuals who could not recover the VAT, unlike businesses that could claim deductions. The increased cost of motor insurance also impacted public transportation fares, as commercial transport operators transferred the additional costs to passengers, ultimately driving up the cost of goods and services.

The removal of VAT on motor vehicle insurance is expected to ease the financial burden on households and promote fairness in the tax system, Dr. Forson added.

He stated that the government believed that by eliminating this tax, they would help lower transportation costs, indirectly reducing inflationary pressures on goods and services.

By Ernest Kofi Adu, Parliament House