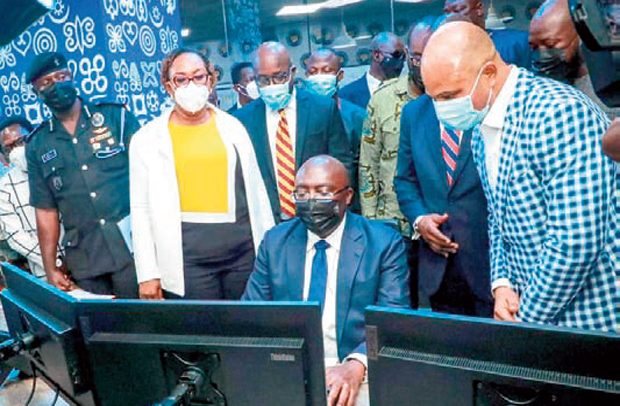

Vice President Bawumia launching the tracker

Vice President Dr. Mahamudu Bawumia yesterday launched a new National Retail Outlet Fuel Monitoring System (NROFMS) aimed at bringing sanity into the supply and distribution of petroleum products in the country.

The system was developed by the National Petroleum Authority (NPA) to help improve efficiency and profitability in the petroleum downstream sector.

The system, which is also known as the Automatic Track Gauging and Forecourt Transaction Control System, uses a 3D calibex device to monitor fuel stock that does not only aid in reading fuel tank levels but also monitors sales data 24/7 at the fuel retail outlets.

Dr. Bawumia said the system was also intended to block revenue leakages in the sector since the state is reported to have lost an estimated amount of GHc4.7 billion in tax revenue between 2015 and 2019 in the petroleum distribution chain.

Speaking at the launch in Accra, the Vice President commended the board, management and staff of the NPA for leveraging on technology to bring efficiency in the distribution of petroleum products.

Dr. Bawumia said it was imperative to block all revenue leakages in the petroleum downstream sector to ensure transparency and accountability since taxes and levies on petroleum products enable the government to maximise revenue.

He reiterated the government’s vision of digitising the Ghanaian economy towards achieving the ‘Ghana Beyond Aid’ agenda, and highlighted the digitisation of pre-mix fuel for fisher folks in 2018.

He charged the NPA and the Ministry of Fisheries and Aquaculture Development to complete the digitisation process this year in order to halt the illicit activities in the sector.

The Vice President expressed optimism that the fuel monitoring system would be extended to the landing beaches across the country to help in the management of government’s subsidized premix fuel distribution to the fisher folks.

He again tasked the NPA to halt the granting of third party supplies by Oil Marking Companies (OMCs) who are in good standing to their indebted counterparts in order to evade payment of statutory levies and margins.

Dr. Bawumia also asked the NPA to have a read-only access to the accounts held by the Ghana Revenue Authority (GRA) on petroleum downstream revenue matters to enable it conduct a thorough reconciliation and validation of stock movement and all related financial data.

It is again to enable the NPA to detect any variations between the taxes collected by the Ghana Revenue Authority and their official sales for redress.

Currently, the NPA operates a 10-day credit period, while the GRA operates a 25-day credit period which the Vice President said does not help in reconciliation of tax collection.

The directive indicated that for greater effectiveness, it was essential to synchronize the credit periods adopted by these two institutions.

By Charles Takyi-Boadu, Presidential Correspondent