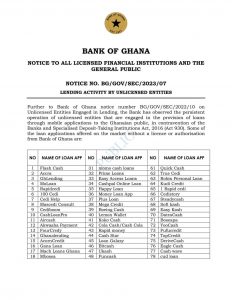

In a bid to safeguard customer data, privacy, and consumer protection, the Bank of Ghana has issued a public notice emphasizing the continuous operation of some 97 unlicensed entities involved in lending through mobile applications.

These entities are in direct violation of the Banks and Specialised Deposit-Taking Institutions Act, 2016 (Act 930).

The central bank has highlighted that the activities of these unlicensed loan providers pose a significant threat to customer data and privacy, as well as consumer protection requirements. These violations have adverse implications for the integrity and wellbeing of their customers.

The Bank of Ghana, in collaboration with relevant state agencies, has vowed to take action against these unlicensed entities to ensure the integrity of financial service delivery.

It urges the general public to refrain from engaging in any transactions with unlicensed loan providers.

Furthermore, banks, specialized deposit-taking institutions, and payment service providers are cautioned not to facilitate any illegal activities associated with unlicensed loan applications.

To ensure a safe and reliable lending platform, the Bank of Ghana encourages the public to opt for the various digital credit products approved and regulated by it.

These products are made available through partnerships between banks, specialized deposit-taking institutions, and mobile money operators, and can be accessed remotely via mobile money wallets 24/7, without the need for collateral.

By embracing these approved digital credit options, Ghanaians can enjoy the convenience and accessibility of loans while having the peace of mind that their personal data and privacy are protected within the legal framework.

The Bank of Ghana continues to prioritize the promotion of a secured and trustworthy financial ecosystem. It advises the public to remain vigilant, exercise caution, and report any suspicious financial activities to the appropriate authorities. Compliance with the central bank’s regulations and guidelines is crucial for the overall safety and stability of the financial sector in Ghana.

By Vincent Kubi