A Deputy Finance Minister, John Kumah, has debunked claims that the Ghana cedi is the weakest currency in Africa.

According to him, such a claim is mere propaganda meant to undermine the government’s fiscal measures in halting the free fall of the cedi against the dollar.

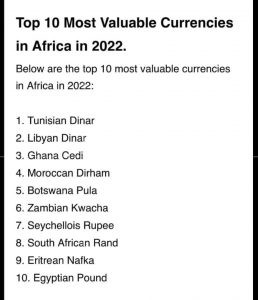

He stated that the cedi is currently the third strongest currency in Africa; however, he conceded that the rate of depreciation the cedi is experiencing might be the worst on the continent.

Dr. Kumah speaking on Joy News noted that currencies across the world are experiencing depreciations and thus, critics of the government’s fiscal policies cannot blame the poor performance of the cedi on fiscal mismanagement.

According to him “And look, I’ve heard all the propaganda, they said Ghana cedi is the worst in Africa and all kinds of things. Look, don’t believe those propaganda. I just returned from Tunisia on a programme, and Tunisia has the second strongest currency in Africa”.

“Ghana is third actually according to global ranking of currencies. I am talking about the strength of currencies in Africa. The Libyan Dinar, followed by Tunisian Dinar, and then the Ghana cedi is the third strongest currency in Africa. But maybe they were talking about the rate of depreciation”.

“I just saw what is happening in Nigeria and they are equally complaining that their Naira is not just four hundred and something to the dollar, but sometimes it’s even 700 depending on where … sometimes they can’t even find the dollar. So this is a global situation.”

He added, “So it is not just a Ghana situation, it is something that is happening globally and people should not begin to think that it’s as a result of some bad policy or whatever.”

He stated that the government has put in place some measures it believes would stabilize the cedi against the dollar and shore up the economy.

“But the good news is that…like we announced government is intervening with these foreign exchange auctions which occasionally Bank of Ghana does to intervene in the market to bring calm and stability to the foreign exchange front.

“And then we have also introduced this gold buying to shore up our reserves in gold. And not just that we are also expecting the Cocoa syndicated loans by the end of the month or early next month which will equally come in to shore up our economy,” he said

BY Daniel Bampoe