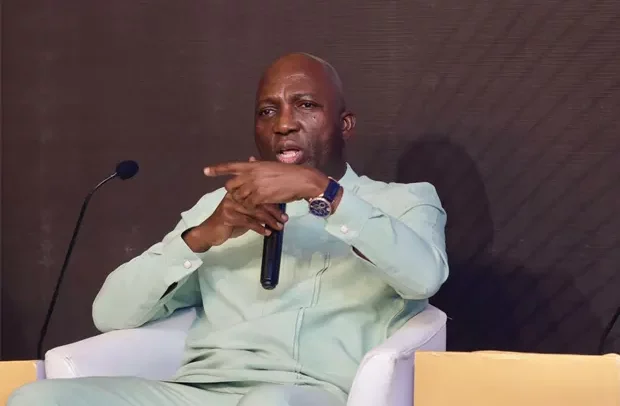

Shaibu Haruna

Chief Executive Officer (CEO) of Mobile Money Limited, Shaibu Haruna, has suggested the use of digital footprints as an alternative means to bridge the credit risk gap between financial institutions and Small and Medium Enterprises (SMEs) in the country.

This proposition comes in response to perceptions about financial institutions being hesitant to lend to SMEs due to the lack of organization and formality in the majority of these businesses.

Speaking at the 2024 MTN Business Executive Breakfast Series on the topic “Bridging the Credit Risk Gap for SMEs in Ghana,” Mr. Haruna highlighted that digital footprints can provide a wealth of information for financial institutions to assess credit worthiness.

These footprints include online behavior, social media presence, and digital transactions of SMEs.

He emphasised that leveraging digital footprints enables lenders to make data-driven decisions, verify identities, and prevent fraudulent activities.

Shaibu Haruna stressed the potential of financial technology to address frictions in the SME lending process, stating, “The very essence of financial technology is actually to address frictions.” He pointed out that the daily generation of digital footprints through transactions and social media usage presents an opportunity to disrupt the concept of risks in lending.

By using advanced technologies like AI, he proposed that customer profiling and tailored solutions could be designed based on these digital footprints.

Mr. Haruna called on stakeholders within the financial sector to re-evaluate the concept of risks and explore how digital technology can be leveraged to change the narrative.

He emphasized the potential of using digital footprints to address risk issues and enable broader access to credit for those who need it within the SME space.

CEO of Ghana Enterprising Agency, Mrs. Kosi Yanky-Ayeh, added that there are challenges that need to be addressed to reduce the perceptional risk associated with financial institutions lending to SMEs.

She emphasised the importance of intentional dedication and focus by financial institutions in supporting SMEs through policy directions designed to bolster small businesses.

BY Prince Fiifi Yorke