In a bold declaration, Dr. Mahamudu Bawumia, the Flagbearer of the New Patriotic Party, has announced that he will abolish the controversial e-levy, bet tax, and emissions tax if elected as President of Ghana.

This announcement comes after the introduction of the e-levy in 2022, a tax that Vice President Bawumia had previously expressed opposition to.

He had since maintained silence over the controversial levy.

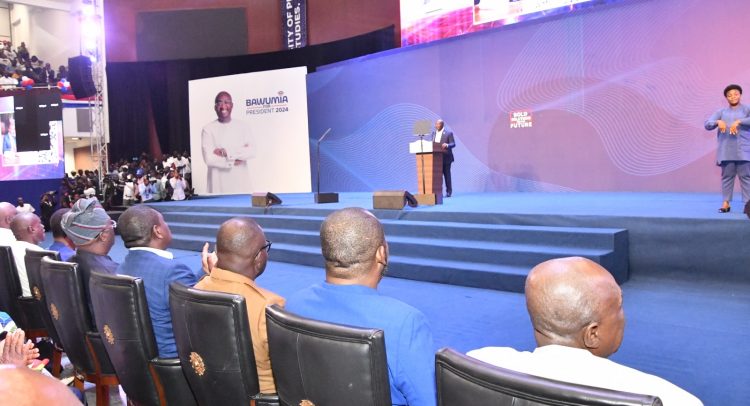

During his first major address to the nation as the NPP flagbearer, Dr. Bawumia firmly stated his opposition to taxes on electronic financial transactions and emphasized that he would abolish the e-levy to promote a cashless economy.

He believes that encouraging the population to use electronic payment channels is crucial for achieving a digital and cashless Ghana.

Furthermore, Dr. Bawumia revealed plans to introduce a new tax regime, which includes abolishing the emission tax, tax on betting, and the proposed 15% VAT on electricity tariffs, if it remains in effect by January 2025.

He expressed his aim to create a friendly and flat tax regime that would benefit individuals and businesses, especially small and medium-scale enterprises (SMEs) that constitute the majority of businesses in Ghana.

Under his proposed tax regime, a flat percentage of income for individuals and SMEs would be implemented, with exemption thresholds put in place to protect the economically disadvantaged.

Dr. Bawumia’s pledges to abolish these taxes and introduce a simplified tax system have sparked both excitement and skepticism among Ghanaians.

Critics argue that the loss of revenue from these taxes could have a considerable impact on the government’s ability to fund essential services and development projects.

However, supporters believe that the elimination of these taxes will stimulate economic growth, encourage investment, and alleviate the financial burden on individuals and businesses.

As the race for the presidency heats up, Dr. Mahamudu Bawumia’s promises regarding taxation have become a central point of discussion and will undoubtedly influence voters’ decisions in the upcoming elections.

By Vincent Kubi