The government has reiterated the need for the introduction of the electronic levy, also known as e-levy.

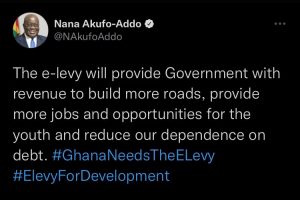

The President tweeted on Wednesday, January 27, 2022, that the E-Levy will among other things reduce the country’s dependence on foreign aid.

“The e-levy will provide the government with revenue to build more roads, provide more jobs and opportunities for the youth and reduce our dependence on debt.“

His comment is part of efforts by the government to sensitize the public on the need for the introduction of the controversial e-levy, including a nationwide town hall meeting which is starting in Koforidua today, Thursday.

The government says the feedback from the engagement will inform it on the implementation of the levy.

The E-levy is a new tax measure introduced by the government in the 2022 Budget on basic transactions related to digital payments and electronic platform transactions.

A charge of 1.75% will apply to electronic transactions that are more than GH¢100 on a daily basis.

The town hall meeting will feature Minister for Finance, Ken Ofori-Atta, Minister for Communication and Digitalization, Ursula Owusu-Ekuful, Minister for Information, Kojo Oppong Nkrumah and Deputy Majority Leader, Alexander Afenyo-Markin.

Also, to be in attendance at the forums will be sector-specific Civil Society Organisations (CSOs) and other relevant industry stakeholders.

The Town Hall Meeting is being organised by the Ministry of Information and will be live on various television networks in the country as well as the Ministry’s social media pages.

E-Levy will cover:

a. Mobile Money Transfers between accounts on the same electronic money issuer (EMI).

b. Mobile Money transfers from an account on one EMI to a recipient on another EMI.

c. Transfers from bank accounts to mobile money accounts.

d. Transfer from mobile money accounts to bank accounts.

e. Bank transfers on a digital platform or application originate from a bank account belonging to an individual to another individual.

E-Levy will not impact:

a. Cumulative transfers of GHS 100 per day made by the same person.

b. Transfers between accounts owned by the same person.

c. Transfers for the payment of taxes, fees, and charges on the Ghana.gov platform.

d. Electronic Clearing of Cheques.

e. Specified merchant payments (i.e. payments to commercial establishments registered with GRA for Income Tax and VAT purposes).

f. Transfers between principal, master-agent, and agent’s accounts.