A fuel attendant at work

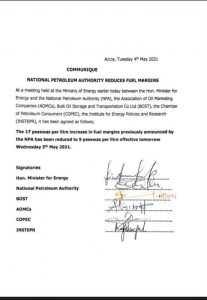

GOVERNMENT HAS announced a reduction in fuel margins by GH¢0.09 from GH¢0.17 previously announced.

A communique by the National Petroleum Authority (NPA), which made this known, follows a meeting between the Energy Minister, National Petroleum Authority, the Association of Oil Marketing Companies, Bulk Oil Storage and Transportation Company Limited, the Chamber of Petroleum Consumers and the Institute for Energy Policies and Research yesterday in Accra.

The NPA indicated that “the 17 pesewas per litre increase in fuel margins previously announced by the NPA has been reduced to 9 pesewas per litre effective tomorrow Wednesday, May 5, 2021.”

BOST Clears Air

Preceding the reduction, the Institute for Energy Studies (IES), a civil society organisation, made some allegations against the Bulk Oil Storage and Transportation (BOST) Company Limited on the fuel margins.

Such allegations, BOST indicated, were far unfortunate and untrue.

Describing that as a sensationalised interpretation by the Institute for Energy Studies (IES) in the media, BOST said a claim by the IES that BOST’s upward adjustment of the petroleum margin eleven months ago was not properly justified were false. It also said IES’s allegation that BOST had continued to underperform despite the intervention as unfair.

According to BOST, it was the failure on the parts of successive governments to review the margin from 2011 which had resulted in massive dilapidation and in some instances, decommissioning of some of these strategic assets.

It therefore said the upward adjustment received before the current reduction had stemmed the tide of dilapidation of assets that stared the company in the face while also it has restored such assets back to life and into use.

“The twisted interpretation is therefore unfortunate,” it mentioned.

It added that the statement that BOST was still managing the margin was simply false and should be disregarded.

“On the GH¢0.03 upward adjustment in the BOST margin, our initial request was GH¢0.09 to restore the value to the 2011 dollar value. Despite our unsuccessful attempt, the increment of GH¢0.03 has been efficiently utilised by the company.

In January 2017, BOST recorded a debt of $623 million to suppliers and related parties; and was served with a $36 million claim by Bulk Distribution Companies (BDCs) for products lost in the BOST system. It also decommissioned petroleum barges; witnessed the non-operation of the Tema-Akosombo-Petroleum-Product-Pipeline (TAPP) since 2015; Buipe-Bolgatanga-Petroleum-Product-Pipeline; also the Bolgatanga and Maame Water Depots since 2015; also had old fashioned pumps and meters across the depots while also GH¢237 million debt was owed to a number of domestic banks including Ghana Commercial Bank, Fidelity Bank, UBA and UMB, among others. Fifteen (15) tanks decommissioned out of fifty-one (51) tanks of the company.

“As we speak, thanks to the upward adjustment, continuous government support and the efficient management of BOST as an entity, the company now boasts of a functional Bolgatanga depot exporting products to the landlocked countries of the Sahel region; a successful repair of nine (9) out of fifteen (15) decommissioned tanks; paid debts to suppliers and related parties down to $50 million; a successful vetting of BDC lost product claims of $36 million down to $14.8 million; fully repaired Buipe Bolgatanga Petroleum Product Pipeline; fully repaired Tema Akosombo Petroleum Product Pipeline while also the Bulk Road Vehicle Truck Park at Bolgatanga is 90% completed,” it stated.

“Additionally, BOST has made outright settlement of debts owed domestic banks; successfully repaired all petroleum barges; returned to shipping 3.3 million liters of products per trip of the barges from Akosombo to Buipe, the equivalent of 62 trucks loading an average of 54,000 liters per truck, while it has cut down its operational expenses per year from a GH¢453 million in 2016 to GH¢190 million in 2019, among others,” it said.

“We at this point call on general public to have confidence in the current management and look forward to nothing but the best from the company,” it appealed.

By Melvin Tarlue