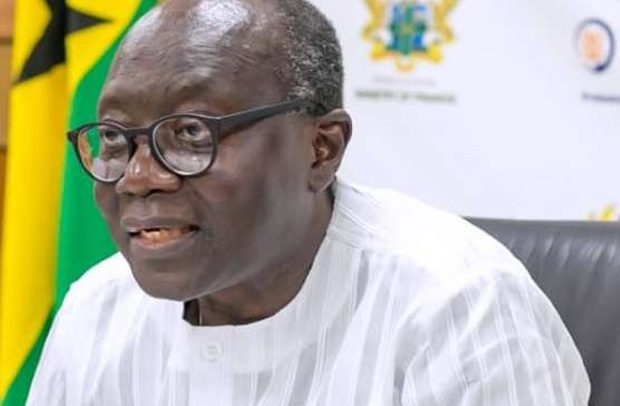

Ken Ofori Atta, Finance Minister

The Ministry of Finance says it has issued instructions for settlement of the GH¢2.4 billion first coupon payment under the Domestic Debt Exchange Programme (DDEP).

According to the Ministry, new bonds now stand as the dominant instruments in the country’s domestic bond market, laying the basis for rapid recovery.

“We remain committed to the success of the new bonds, and again thank all those who participated in the DDEP for their sacrifices,” the Ministry announced on X (formerly Twitter).

The government was expected to settle nearly GH¢2.5 billion coupons that matured yesterday to bondholders.

The Finance Ministry explained that the payment was in line with the credibility of Ghana’s domestic debt operation.

“In line with the government’s commitment to the continued success and credibility of Ghana’s domestic debt operations, instructions have gone out for the settlement of the GH¢2.4 billion first coupon payment of the DDEP, due today,” the Ministry tweeted.

As part of its efforts to address its liquidity challenges, the government launched a domestic debt exchange on July 14, 2023, inviting eligible holders to exchange approximately USD809 million of its US dollar denominated domestic notes and bonds for a package of new bonds to be issued by the government.

The invitation’s terms and conditions were outlined in the exchange memorandum.

The government announced an extension of the invitation on August 7, 2023, to offer qualified holders more time to acquire internal authorisation to participate.

Capitalized terms that appear but are not defined above have the meaning assigned to them in the Exchange Memorandum, the Finance Ministry said.

The Government thanked all eligible holders who tendered their eligible bonds, the Ministry indicated and added, “As of Friday, August 18, 2023, eligible holders holding a substantial majority of all eligible bonds amounting to approximately 91% had tendered the eligible bonds.”

“With the purpose of affording holders who have not tendered additional time to secure internal approvals to participate, today the Government announced its decision to provide an administrative window for them to tender and extend the invitation to exchange.

It stated that the expiration date was Friday, August 25th, 2023 at 4:00 p.m. (GMT), and that the announcement date was on or about Monday, August 28th, 2023.

It further stated that the settlement date would be on Friday, September 1, 2023, or as soon as possible thereafter.

According to the Ministry, the longstop date will be Monday, September 4, 2023, unless the Republic extends the invitation.

The New Bonds’ issue date, interest accrual schedules, payment schedules, and amortization schedules will be updated to reflect the actual settlement date. Except as stated in paragraphs 5 and 6, the invitation’s original terms and conditions are not updated or amended.

“Any eligible holders whose eligible bonds are held on its behalf by a broker, dealer, bank, custodian, trust company, or other nominee must contact such an entity if it wishes to participate in the invitation, as such entities may establish an earlier deadline to receive instructions to tender eligible bonds,” the Ministry said.

By Ernest Kofi Adu