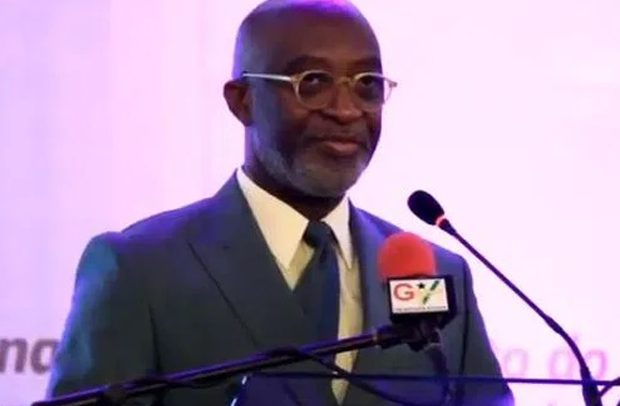

Yofi Grant, Chief Executive Officer (CEO) of the Ghana Investment Promotion Centre (GIPC)

Foreign Direct Investment (FDI) inflows for the year 2020 surged to a total of $2.6 billion despite the raging Covid-19 global health pandemic.

The impressive worth of inbound investments for the year under review defied the projected steep decline in FDI flows as the effects of Covid-19 posed greater challenges for the Ghanaian economy.

Presenting the investment report for the 4th quarter of 2020, Chief Executive Officer (CEO) of the Ghana Investment Promotion Centre (GIPC), Yofi Grant, said total investment inflows peaked at $2,796.49m in 2020, with a total FDI value of $2,650.97m for Ghana.

“The FDI value of $2,650.97 million illustrates a significant increase of 139.06% over the FDI value of $ 1,108 93 million recorded in 2019,” he said during the press briefing.

Mr Grant indicated that while Ghana had initially witnessed a plateau in FDI inflows during the first wave of the Covid-19 infection and its ensuing lockdowns, investments saw a rebound on the back of government policy responses to mitigate the impact of the health pandemic on businesses.

“With the considerable inflow of investments, some 279 projects were registered within the year. This comprised 129 newly registered projects 131 upstream developments and 19 free zones activities -dispersed across eight regions, with Greater Accra registering the highest number of 231 projects. Cumulatively some 27,110 jobs are expected to be generated from the aforementioned registered projects.

For the year under review, some countries that stood out as nation’s leading sources of inward investments included, China the United Kingdom, South Africa, Australia and the Netherlands,” he noted.

In terms of the sector allocation of the investments, he said the manufacturing sector which had 57 projects, recorded the largest FDI value of $1,270.53 million.

This was followed by the services and mining sectors with FDI values of $656.19 million and US$ 424.32 million respectively.

On the domestic front, the country recorded additional equity (cash and goods) totalling $69 26 million was ploughed back as investment from 172 already existing companies, whereas $250.68 million (GHC1,438.91 million) was obtained from 52 wholly Ghanaian-owned ventures.

“While this trend of strong performance in Ghana’s inbound FDI amidst the global health pandemic could be attributed to a combination of factors including effective government policy responses, an easing of travel restrictions and more importantly the delivery and expected future development of vaccines in-country, the GIPC’s notable efforts as the leading Investment Promotion Agency also played a pivotal role in attracting investors,” he added.

The GIPC CEO said as Ghana steps into an era of liberalized trade under the AFCFTA, there is an even stronger commitment from the Center to boost investor confidence and ultimately harness valuable investments for Ghana, now Africa’s Business Capital.

By Jamila Akweley Okertchiri