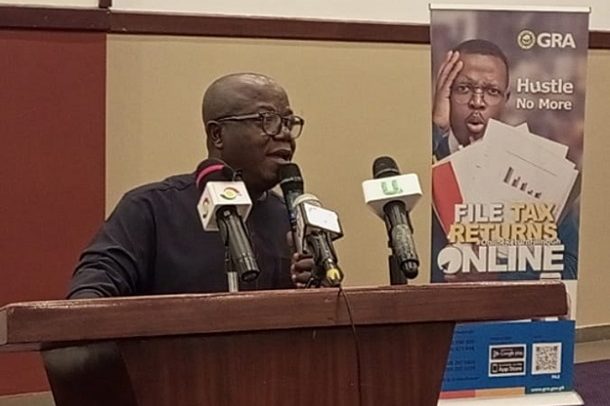

Edward Apenteng Gyamerah

The Domestic Tax Revenue Division (DTRD) of the Ghana Revenue Authority (GRA) is poised to explore creative ways of mobilizing revenue for economic management in 2024.

The Division is also committed to facilitating voluntary tax compliance through measures such as new technologies and introduction of tax policies that support the very cause.

It also intends to begin the implementation of modify taxation and also launch the Voluntary Disclosure Programme to allow resident persons with sources of income abroad to disclose their income for the Division to determine whether they are taxable or not.

The Commissioner of the DTRD of GRA, Edward Apenteng Gyamerah, who revealed this at DTRD’s 2024 management retreat in Takoradi, encouraged the staff of GRA to maintain the same commitment and dedication in this new financial year.

The retreat was on the theme “Tax Transparency and Certainty: The GRA Way”.

It was also to discuss 2023 revenue performances and map out strategies as to how to consolidate DTRD’s role in domestic revenue mobilization.

He disclosed that the Domestic Tax Revenue Division collected GH¢ 82.295 billion as revenue in 2023 against GH¢ 53.444 billion collected in 2022.

“This feat enabled DTRD to surpass its revenue target with a deviation of 7.2 per cent on target,” he said.

He revealed that DTRD is mandated to collect GH¢111 billion in 2024, out of the total revenue target of GH¢170 billion for the year by GRA.

He pointed out that the Division recorded a growth of 180 per cent in the last four years.

He ascribed DTRD’s excellent performances to initiatives implemented to expand the tax base and also enforcement.

He praised the dedicated staff of the division and said “DTRD could not have achieved this milestone without your dedication and commitment”.

“On our part as management, we commit to continue putting in place strategic measures and initiatives to facilitate tax compliance,” he said.

He also thanked the Customs Division, staff, and tax payers for the team work and collective collaboration in the implementation of policies and strategies to achieve revenue targets over the years.

“You remained true to the call despite the challenges you face, ensuring that our common vision of being a world-class revenue administrators is achieved,” he noted.

He added, “I am confident that we will continue with this momentum in 2024.I look forward to working with all of you in this new financial year,” he told the workers.

From Emmanuel Opoku, Takoradi