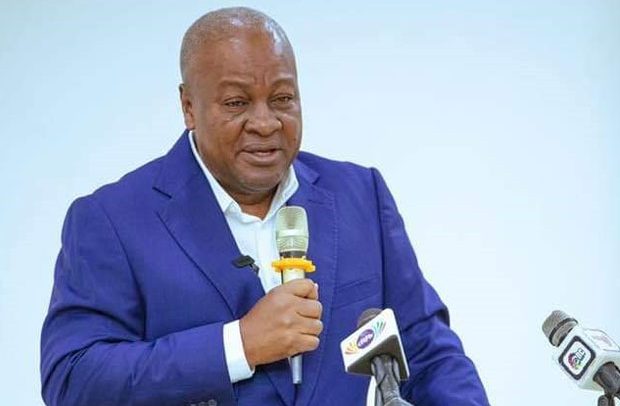

Former President John Dramani Mahama, has announced plans to restore the banking licenses of institutions that he says were unjustly revoked during the government’s financial sector reforms.

Mahama hopes to revive the banking industry and boost financial confidence with a tiered banking system that will serve different segments of the market, and offer opportunities for experienced banking professionals who were laid off during the reforms.

Speaking at the University of Development Studies (UDS) in Tamale, the flagbearer-elect of NDC for 2024 elections said “We will restore indigenous investment and the banking and investment sector. We will create a tiered banking system that will serve the various segments of the market. We will give an opportunity for experienced banking hands who were laid off to secure their careers once more and move away from the menial jobs that they were forced into. As far as practicable, the banking licenses that were unjustly cancelled by this government will be restored”.

He added “We will rejuvenate the almost collapsed banks. This will involve sweeping reforms at the Bank of Ghana. Because the Central Bank itself is a part of creating this problem. I will create the foundation that will ensure that, Ghana will not suffer such a deadly debt management programme that almost our elderly people holding government bonds to an early grave and wipe out the investments of the Ghanaian middle class.”

The former President also hopes to re-employ staff whose appointments were terminated during the banking sector clean-up, and advocate for improvements at the Bank of Ghana in light of its weak oversight, which he believes contributed to the problems.

The total cost of the government’s fiscal intervention from 2017 to 2019 was estimated at GH¢16.4 billion, with the government claiming the cost shot up to GH¢21 billion on the 2020 banking clean-up exercise.

This, he claims, is one of the rafts of measures aimed at revitalizing the banking industry and boosting financial confidence.

The banking sector clean-up started from mid-2017 to January 2020. The clean-up saw a reduction in the number of banks from 34 to 23, whilst 347 microfinance institutions, 15 savings and loans and eight finance houses had their licences revoked.

The government said that it spent about GH¢21 billion on the banking clean-up exercise.

By Vincent Kubi