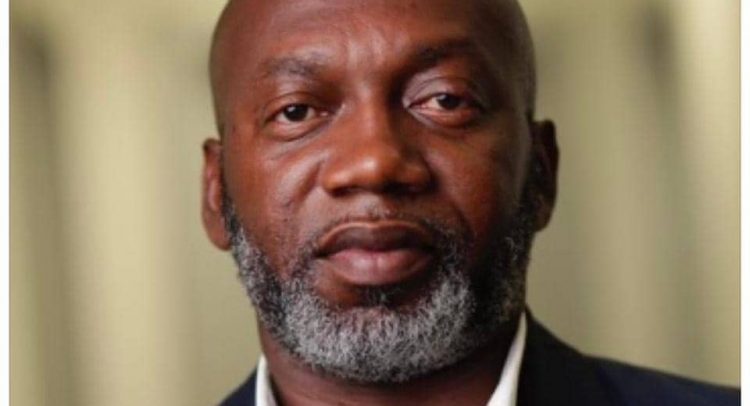

Augustine Ewiah

The Ghanaian property market has witnessed a significant shift in recent times, with many individuals and investors scrambling to acquire properties due to the appreciation of the Ghanaian cedi against the US dollar.

In contrast to the situation three years ago, when the falling rate of the Ghanaian cedi against the US dollar led to a surge in properties being priced in cedis, the current trend sees many potential buyers and tenants eager to invest in properties.

According to Augustine Ewiah, CEO of Cameo 1 Homes, a luxury real estate brokerage company, the previous decline of the dollar led to a supply glut in the high-end segment of the rental market in Accra, with properties having dollar rent tags struggling to find tenants and buyers.

However, with the cedi’s recent appreciation, the market dynamics have changed, and many are now looking to capitalize on the situation by investing in properties.

He mentioned that this change in market trend is likely to have a positive impact on the real estate sector, with potential benefits for property owners, investors, and the broader economy.

“ The appreciation of the Ghanaian cedi has led to increased demand for properties. As it stands now the current market situation presents opportunities for investors to capitalize on the appreciation of the cedi,” he said.

*Cedi Appreciation*

President John Dramani Mahama has attributed the recent rebound of the Ghanaian Cedi to robust foreign exchange inflows and deliberate policy measures aimed at stabilising the economy.

According to the President, the improved performance of the local currency is largely supported by strengthened gross international reserves, which have surged from $8.9 billion in December 2024 to $10.6 billion by April 2025. He noted that this upward trend reflects growing investor confidence and enhanced external financial buffers.

“The Ghanaian Cedi, which depreciated by 19.3% in 2024, has shown signs of recovery, appreciating by 3.9% against the US dollar by the end of 2025. This has been supported by stronger forex inflows, improved trade balances and growing investor confidence.”

By Prince Fiifi Yorke